NO.PZ2018053101000009

问题如下:

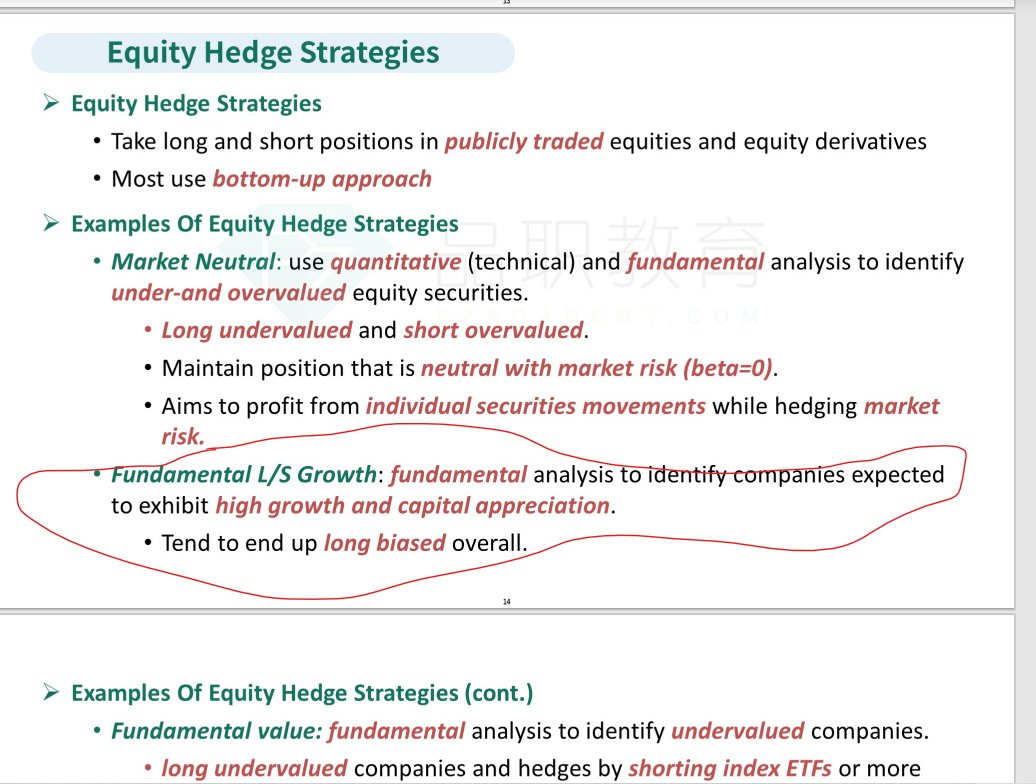

An equity hedge fund following a fundamental growth strategy uses fundamental analysis to identify companies that are most likely to:

选项:

A. be undervalued.

B. be either undervalued or overvalued.

C. experience high growth and capital appreciation.

解释:

C is correct.

Fundamental growth strategies take long positions in companies identified, using fundamental analysis, to have high growth and capital appreciation. Fundamental value strategies use fundamental analysis to identify undervalued companies. Market-neutral strategies use quantitative and/or fundamental analysis to identify under- and overvalued companies.

绝大多数对冲基金策略都是做多做空同时操作的,只有少数几个是单向只做多或者只做空,就包括fundamental growth, fundamental value 以及short bias. 其中,fundamental growth是用基本面研究方法找到高增长的股票,而fundamental value是用基本面研究方法找到被低估的股票。而short bias是卖出被高估的股票。选项中的market-neutral是同时找到被低估和被高估的股票,short那个被高估的,long那个被低估的,那么就可以获得两个阿尔法,市场风险就被对冲掉了,但是承担了更高的非系统性风险。

B就是fundamental analysis啊。C没涵盖 高估/低估的内容吧,为什么选C