NO.PZ201712110200000308

问题如下:

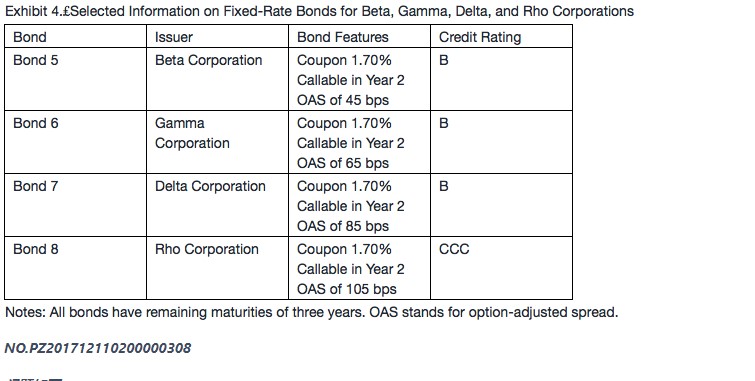

Which of the following conclusions regarding the bonds in Exhibit 4 is correct?

选项:

A.Bond 5 is relatively cheaper than Bond 6.

B.Bond 7 is relatively cheaper than Bond 6.

C.Bond 8 is relatively cheaper than Bond 7.

解释:

B is correct.

A bond with a larger option-adjusted spread (OAS) than that of a bond with similar characteristics and credit quality means that the bond is likely underpriced (cheap). Bond 7 (OAS 85 bps) is relatively cheaper than Bond 6 (OAS 65 bps).

C is incorrect because Bond 8 (CCC) has a lower credit rating than Bond 7 (B) and the OAS alone cannot be used for the relative value comparison. The larger OAS (105 bps) incorporates compensation for the difference between the B and CCC bond credit ratings. Therefore, there is not enough information to draw a conclusion about relative value.