NO.PZ201602060100002006

问题如下:

6. The ratio of operating cash flow before interest and taxes to operating income for Bickchip for 2009 is closest to:

选项:

A.1.6.

B.1.9.

C.2.1.

解释:

B is correct.

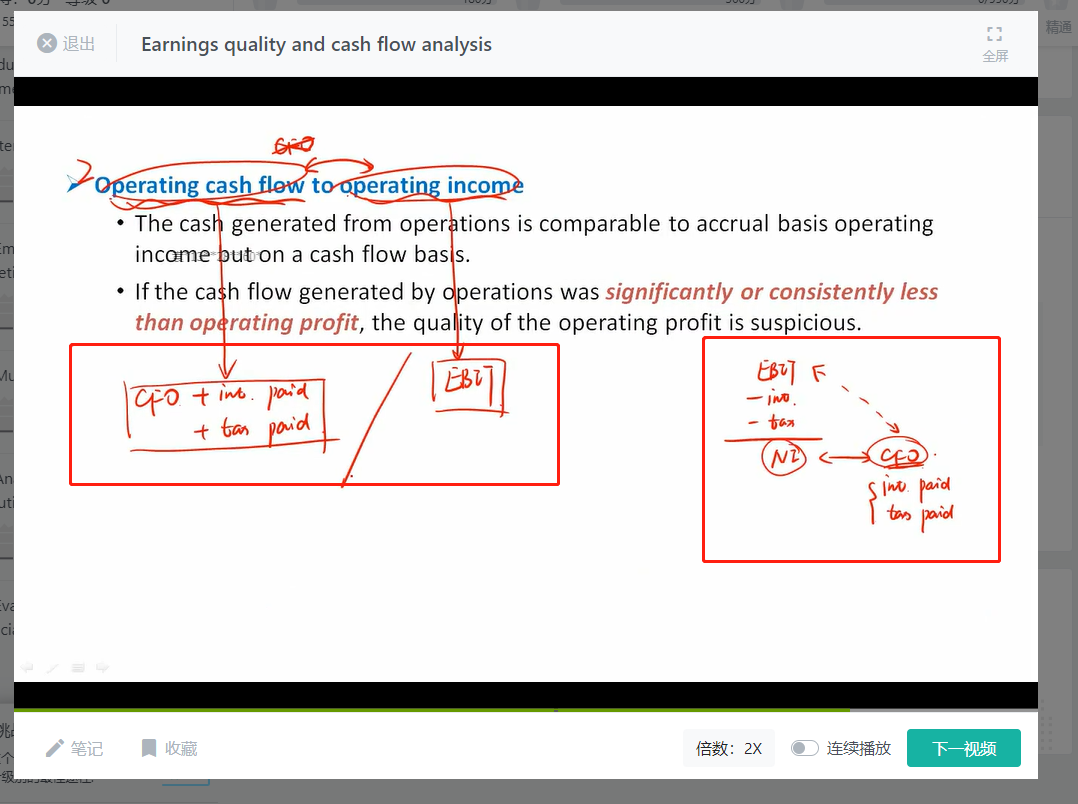

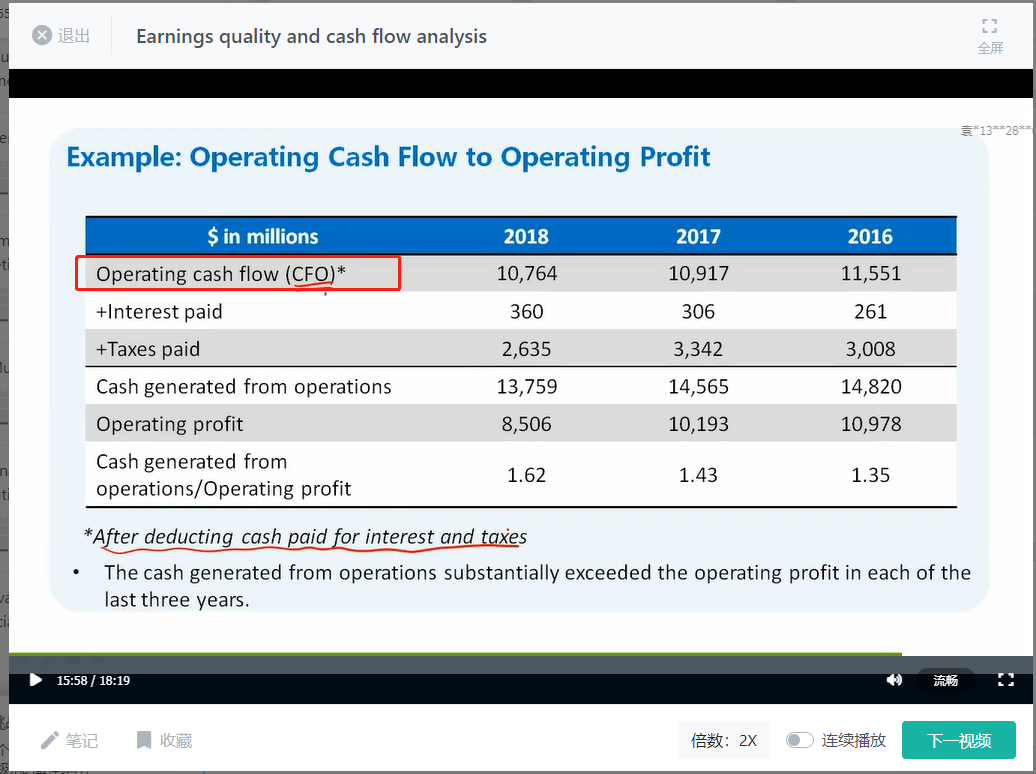

Net cash flow provided by (used in) operating activity has to be adjusted for interest and taxes, as necessary, in order to be comparable to operating income (EBIT). Bickchip, reporting under IFRS, chose to classify interest expense as a financing cash flow so the only necessary adjustment is for taxes. The operating cash flow before interest and taxes = 9,822 + 1,930 = 11,752. Dividing this by EBIT of 6,270 yields 1.9.

解析:ratio of operating cash flow before interest and taxes to operating income=(CFO+interest+tax)/EBIT。这个ratio是比较经营性现金流和会计上的EBIT,由于EBIT是扣除利息和税收费用之前的数字,为了让分子分母具有可比性,所以要把从CFO中扣除的利息和税加回,但是从Exhibit3最后两行可以知道,Bickchip公司把interest expense归为CFF,把tax归为CFO,因此计算2009年的这个ratio的时候只需要在分子上加回tax,也就是等于(9822+1930)/6270=1.9

本题要求一一对应,即(CFO+interest+tax)/EBIT,CFO中原本扣除的税要加回,tax即使分类为CFF,但不也要考虑吗,为什么本题分母不加上?