NO.PZ201812100100000506

问题如下:

Relative to its domestic tax rate, Triofind’s effective tax rate is most likely:

选项:

A. lower.

B. the same.

C. higher.

解释:

A is correct.

Norvolt exempts the non-domestic income of multinationals from taxation. Because Norvolt has a corporate tax rate of 34%, the 0% tax rate in Borliand and the fact that 25% of Triofind’s net income comes from Borliand should result in a lower effective tax rate on Triofind’s consolidated financial statements compared with Triofind’s domestic tax rate. Abuelio’s tax rate of 35% is very close to that of Norvolt, and it constitutes only 15% of Triofind’s net income, so its effect is unlikely to be significant.

解析:A国家税率是35%,和母公司所在国家税率相差不大,且A公司NI占比也较少(15%),所以A公司所在国家的税率对母公司的有效税率影响不大。N国家的企业税率是34%,B国家是0%,而且B公司的NI占了集团总NI的25%,占比大,而且还免税,对母公司的税收会有减轻的作用。

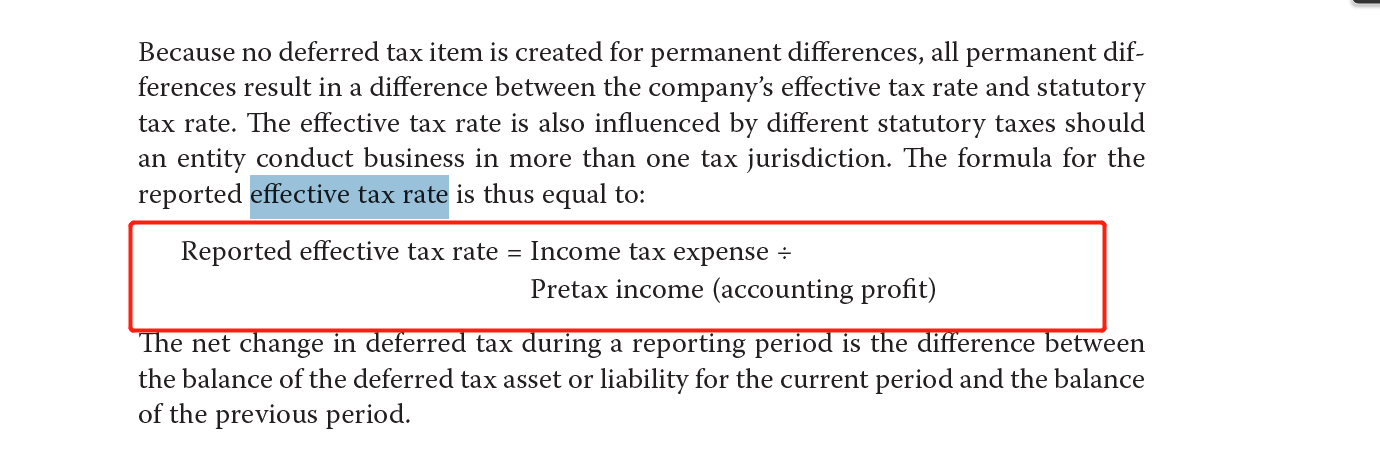

不考虑此题,请问effective tax rate 计算公式是什么