NO.PZ201602060100001107

问题如下:

An adjustment to Kensington’s statement of cash flows to reclassify the company’s excess contribution for 2010 would most likely entail reclassifying £210 million (excluding income tax effects) as an outflow related to:

选项:

A.

investing activities rather than operating activities.

B.

financing activities rather than operating activities.

C.

operating activities rather than financing activities.

解释:

B is correct.

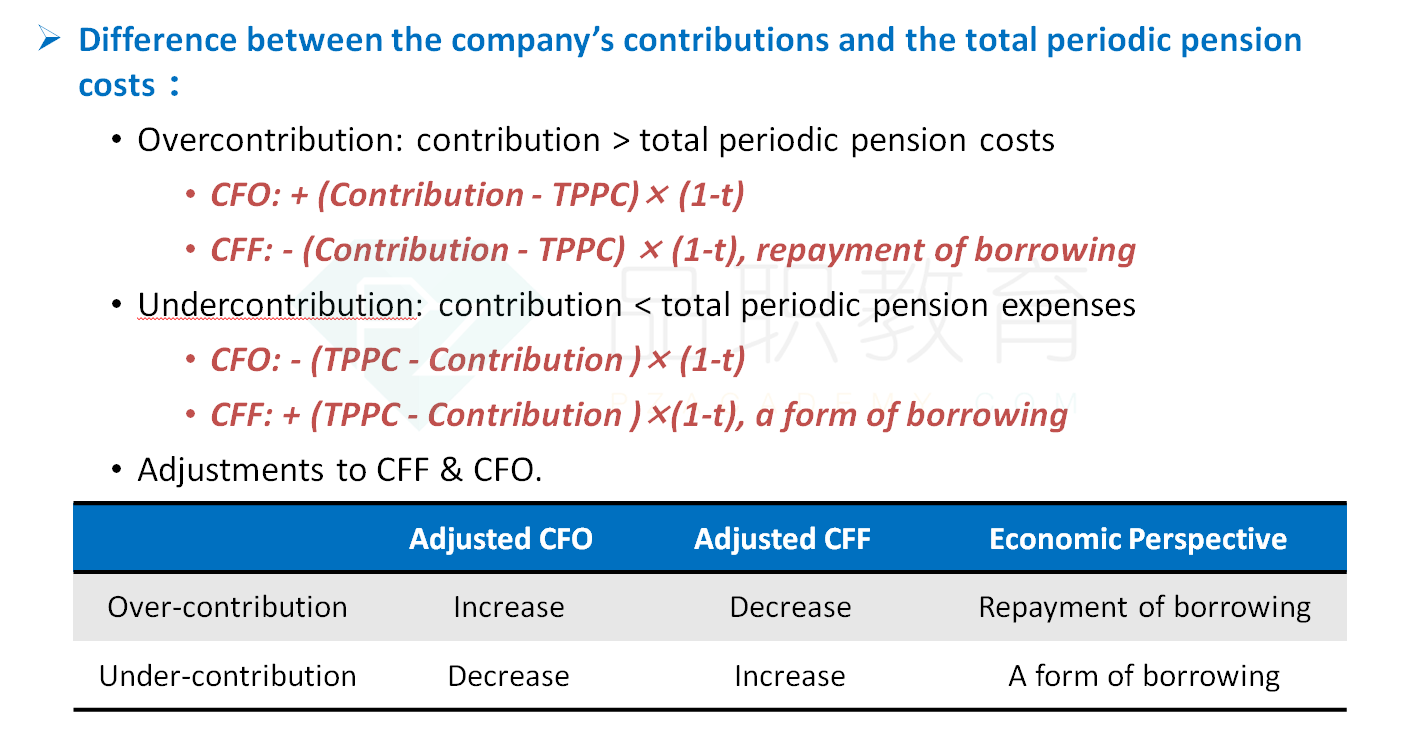

Kensington’s periodic pension cost was £483. The company’s contributions to the plan were £693. The £210 difference between these two numbers can be viewed as a reduction of the overall pension obligation. To adjust the statement of cash flows to reflect this view, an analyst would reclassify the £210 million (excluding income tax effects) as an outflow related to financing activities rather than operating activities.

考点:站在分析师角度,对CF/S的调整

解析:题目问怎么调整K公司的现金流量表,应该将公司excess contribution210重分类为哪类现金流的流出。

TPPC=£483,contributions=£693,两者之间的差异是£210。

正常情况所有当年的contribution会计都处理为CFO流出,但在分析师的观点中,PPC

请问不管是TPPC大于或者小于contribution,都属于financing activity?