问题如下图:

选项:

A.

B.

C.

解释:

为什么A/r不是该题的PV?

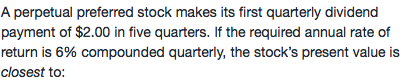

NO.PZ2017092702000009 问题如下 A perpetupreferrestomakes its first quarterly vinpayment of $2.00 in five quarters. If the requireannurate of return is 6% compounquarterly, the stock’s present value is closest to: A.$31. B.$126. C.$133. B is correct. The value of the perpetuity one yefrom now is calculateas: PV = A/r, where PV is present value, A is annuity, anr is expressea quarterly requirerate of return because the payments are quarterly. PV = $2.00/(0.06/4) PV = $133.33. The value toy is (where FV is future value) PV = FV(1 + r)–NPV = $133.33(1 + 0.015)–4 PV = $125.62 ≈ $126 /sp12 /sp\frac12 /sp21 The value toy is (where FV is future value) PV = FV(1 + r)–NPV = $133.33(1 + 0.015)–4

NO.PZ2017092702000009 问题如下 A perpetupreferrestomakes its first quarterly vinpayment of $2.00 in five quarters. If the requireannurate of return is 6% compounquarterly, the stock’s present value is closest to: A.$31. B.$126. C.$133. B is correct. The value of the perpetuity one yefrom now is calculateas: PV = A/r, where PV is present value, A is annuity, anr is expressea quarterly requirerate of return because the payments are quarterly. PV = $2.00/(0.06/4) PV = $133.33. The value toy is (where FV is future value) PV = FV(1 + r)–NPV = $133.33(1 + 0.015)–4 PV = $125.62 ≈ $126 /sp12 /sp\frac12 /sp21 如题

NO.PZ2017092702000009 问题如下 A perpetupreferrestomakes its first quarterly vinpayment of $2.00 in five quarters. If the requireannurate of return is 6% compounquarterly, the stock’s present value is closest to: A.$31. B.$126. C.$133. B is correct. The value of the perpetuity one yefrom now is calculateas: PV = A/r, where PV is present value, A is annuity, anr is expressea quarterly requirerate of return because the payments are quarterly. PV = $2.00/(0.06/4) PV = $133.33. The value toy is (where FV is future value) PV = FV(1 + r)–NPV = $133.33(1 + 0.015)–4 PV = $125.62 ≈ $126 /sp12 /sp\frac12 /sp21 看答案的解析是说, 从Q5才开始pvin可是字面上in five quarters 同样可以理解为未来5个quarters内分别p2 vin 怎么样审题才能看出是从Q5开始分红利

NO.PZ2017092702000009 问题如下 A perpetupreferrestomakes its first quarterly vinpayment of $2.00 in five quarters. If the requireannurate of return is 6% compounquarterly, the stock’s present value is closest to: A.$31. B.$126. C.$133. B is correct. The value of the perpetuity one yefrom now is calculateas: PV = A/r, where PV is present value, A is annuity, anr is expressea quarterly requirerate of return because the payments are quarterly. PV = $2.00/(0.06/4) PV = $133.33. The value toy is (where FV is future value) PV = FV(1 + r)–NPV = $133.33(1 + 0.015)–4 PV = $125.62 ≈ $126 /sp12 /sp\frac12 /sp21 请问这个两阶段模型,第一阶段是后续永续增长的利息折现到t=5,然后用P5再向前折现对吗?P5向前折现为什么不是5次方呢?

NO.PZ2017092702000009 问题如下 A perpetupreferrestomakes its first quarterly vinpayment of $2.00 in five quarters. If the requireannurate of return is 6% compounquarterly, the stock’s present value is closest to: A.$31. B.$126. C.$133. B is correct. The value of the perpetuity one yefrom now is calculateas: PV = A/r, where PV is present value, A is annuity, anr is expressea quarterly requirerate of return because the payments are quarterly. PV = $2.00/(0.06/4) PV = $133.33. The value toy is (where FV is future value) PV = FV(1 + r)–NPV = $133.33(1 + 0.015)–4 PV = $125.62 ≈ $126 /sp12 /sp\frac12 /sp21 不是经过了五个季度吗?