NO.PZ2018062004000130

问题如下:

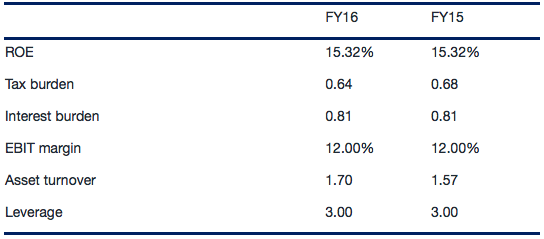

Peter is an analyst, to analyze the financial position of company ADC, he listed the following data. Which of the following conclusions is he most likely to make?

选项:

A.In FY16, company ADC generated more profit than before.

B.In FY16, the average tax rate decreased, but ROE stayed the same due to the decreased profitability.

C.In FY16, the average tax rate increased, but ROE stayed the same due to the improved efficiency.

解释:

C is correct. In the form, only tax burden and asset turnover changed. According to definition, tax burden= 1-average tax rate; asset turnover= net revenue/assets, belonging to activity ratios.

In FY16, tax burden decreased, indicating that average tax rate increased. Asset turnover increased, indicating that efficiency improved, because activity ratios measure the efficiency in using assets to generate revenue. Under the comprehensive effect of the two ratios, ROE stayed the same.The profitability stayed the same because EBIT margin didn't change.

tax burden和average tax rate

总感觉是一个意思呢