NO.PZ2016062402000052

问题如下:

Which of the following four statements on models for estimating volatility is incorrect ?

选项:

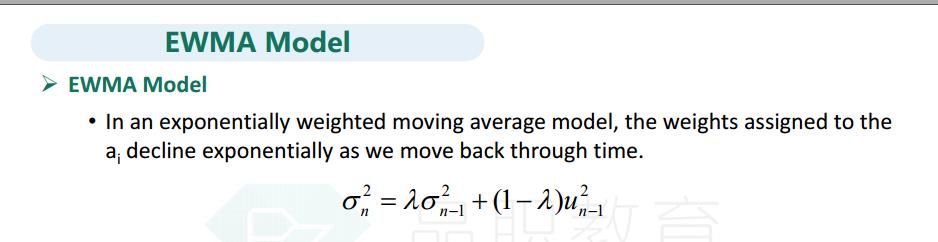

A.In the EWMA model, some positive weight is assigned to the long-run average variance rate.

B.In the EWMA model, the weights assigned to observations decrease exponentially as the observations become older.

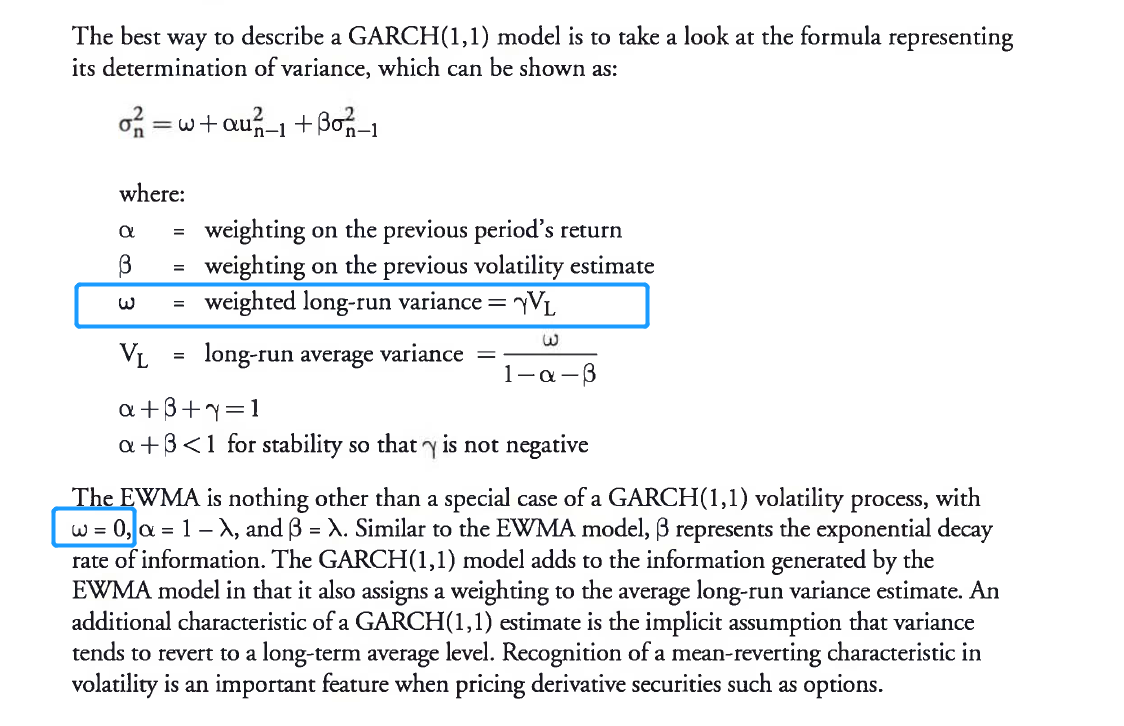

C.In the GARCH(1,1) model, a positive weight is estimated for the long- run average variance rate.

D.In the GARCH(1,1) model, the weights estimated for observations decrease exponentially as the observations become older.

解释:

The GARCH model has a finite unconditional variance, so statement c. is correct. In contrast, because sum to 1, the EWMA model has undefined long-run average variance. In both models weights decline exponentially with time.

看到之前的解答中有提到,a是只为正数,而c是可以为正数。我想问的是,难道weighted不是只能为正数吗?为什么选项a还是错误呢,烦请解答一下,谢谢~