NO.PZ2015122801000052

问题如下:

Bear Company is expected to have a payout ratio of 50% and growth rate of 10%. Assume the rate of return is 15%, What is the firm's leading price-to-earnings (P/E) ratio?

选项:

A.9x.

B.10x.

C.11x.

解释:

B is correct.

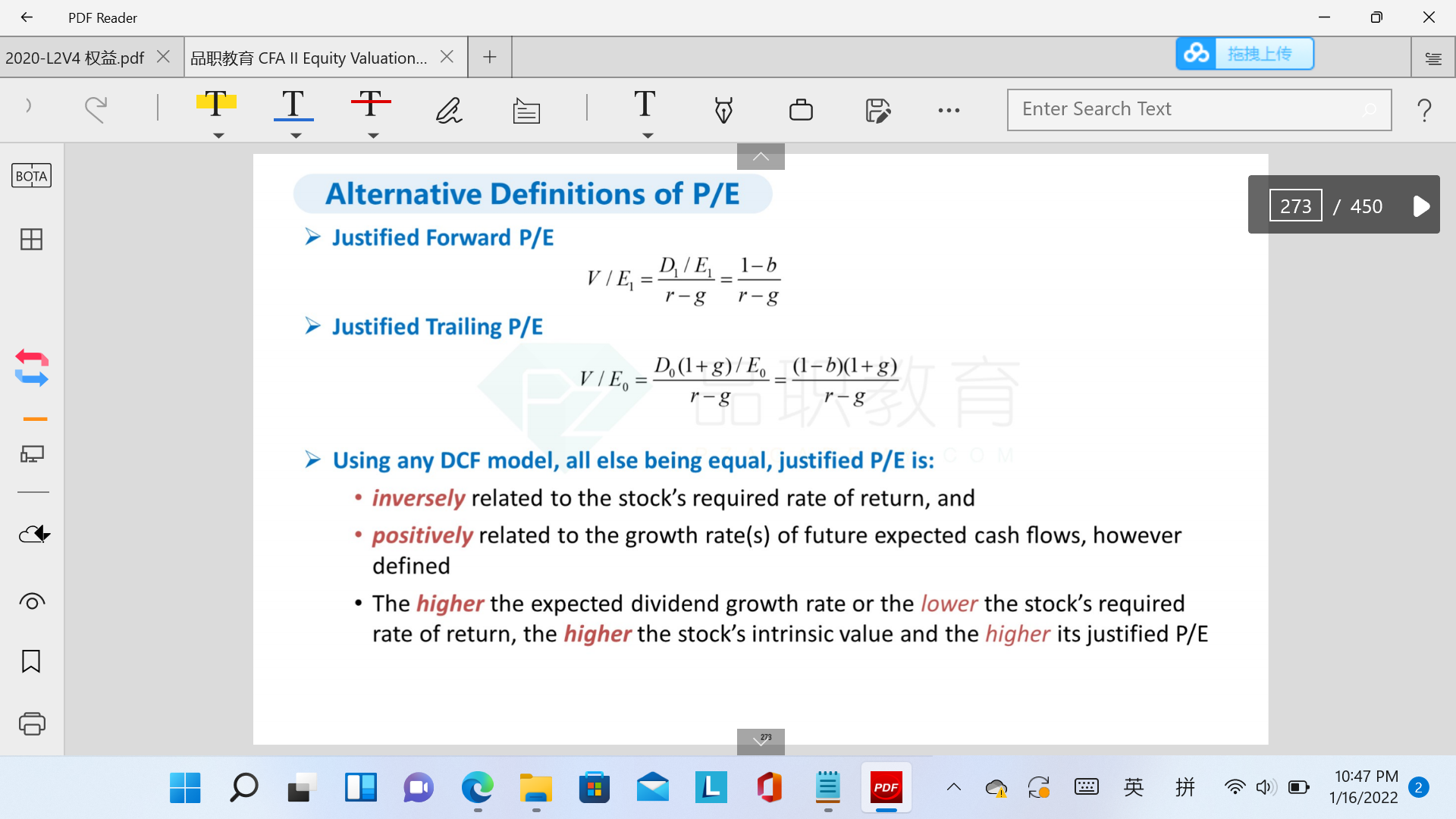

P/E=divident payout ratio /( k-g) = 0.5 / (0.15 - 0.1) = 10x.

B是正确的。

本题考察的是leading P/E的计算公式应用。

P/E1 = (1-b)/(k-g) = 0.5/(0.15-0.1) = 10

如果dividend payout ratio = 1 - RR

那么dividend payout ratio就是dividend吧、

dividend payout ratio 怎么会等于 D/E

dividend payout ratio直译不就是分红比例吗,一单位收益有多少是分红,多少是留存

P/E=divident payout ratio /( k-g) = 0.5 / (0.15 - 0.1) = 10x.

请问E在哪里,题目里在哪里体现?