NO.PZ201512181000007302

问题如下:

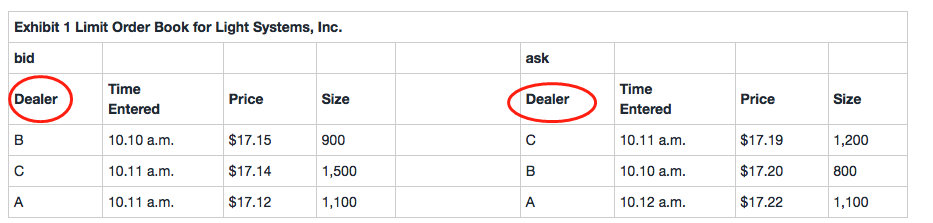

Based on Exhibit 1, the total amount that SAMN will receive, on a per share basis, for executing the market sell order is closest to:

选项:

A.$17.14.

$17.15.

$17.22.

解释:

B is correct. SAMN’s trading desk executes a market sell order for 1,100 shares. Based on the limit order book, the trader would first sell 900 shares at $17.15 (highest bid, Dealer B) and then sell the remaining 200 shares at $17.14 (second highest bid, Dealer C). Therefore, the approximate price per share received by SAMN for selling the 1,100 shares is equal to [(900 × $17.15) + (200 × $17.14)] /1,100 = $17.1482 per share ($17.15 rounded).

如题 ?