NO.PZ2018062007000080

问题如下:

If a call option is priced higher than the binomial model predicts, investors can earn a return in excess of the risk- free rate by:

选项:

A. investing at the risk- free rate, selling a call, and selling the underlying.

B. borrowing at the risk- free rate, buying a call, and buying the underlying.

C. borrowing at the risk- free rate, selling a call, and buying the underlying.

解释:

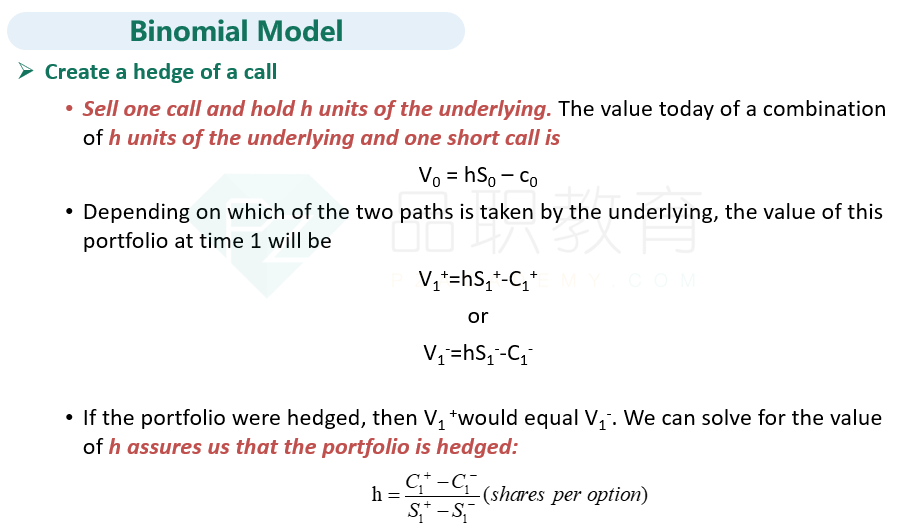

C is correct. If an option is trading above the value predicted by the binomial model, investors can engage in arbitrage by selling a call, buying shares of the underlying, and funding the transaction by borrowing at the risk- free rate. This will earn a return in excess of the risk- free rate.

中文解析:

在二叉树定价模型下,现在认为call被高估了,那么就要short call,同时long一份复制的call。低买高卖进行套利。

而选项中borrowing at the risk-free rate and buying the underlying,也就是借钱买股票就可以复制出一个call,这样我们可以通过卖出一个被高估的call,买入一个合理定价的call来获利。

知道要short call 怎么从short call=long stock+short bond推导出答案?