NO.PZ2016031001000083

问题如下:

A 365-day year bank certificate of deposit has an initial principal amount of USD 96.5 million and a redemption amount due at maturity of USD 100 million. The number of days between settlement and maturity is 350. The bond equivalent yield is closest to:

选项:

A.

3.48%.

B.

3.65%.

C.

3.78%.

解释:

C is correct.

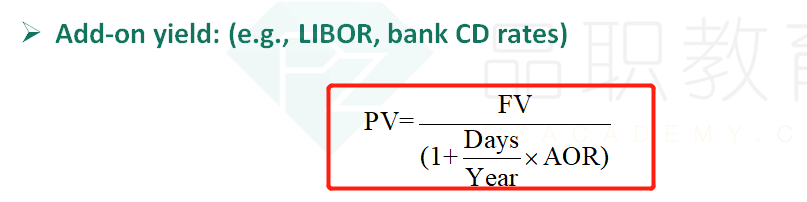

The bond equivalent yield is closest to 3.78%. It is calculated as:

where:

PV = present value, principal amount, or the price of the money market instrument

FV = future value, or the redemption amount paid at maturity including interest

Days = number of days between settlement and maturity

Year = number of days in the year

AOR = add-on rate, stated as an annual percentage rate (also, called bond equivalent yield).

AOR = 1.04286 × 0.03627

AOR = 0.03783 or approximately 3.78%

考点:Bond Equivalent Yield

解析:Bond Equivalent Yield是一年按365天算的Add-on Yield。BEY=【(FV-PV)/PV】×365/days,代入可得BEY=3.78%,故选项C正确。

这个题我的理解是一年期的CD,购买价格是96.5到期赎回价格是100(1年后到期的赎回价格),在15天的时候卖出,然后求BEY。这个和解答不太一致。不知是我翻译理解错了,还是这个题出得有问题?