NO.PZ2020021601000009

问题如下:

Ivan Paulinic, an analyst at a large wealth management firm, meets with his supervisor to discuss adding financial institution equity securities to client portfolios. Paulinic focuses on Vermillion Insurance (Vermillion), a property and casualty company, and Cobalt Life Insurance (Cobalt). To evaluate Vermillion further, Paulinic compiles the information presented in Exhibit 1.

Based only on the information in Exhibit 1, in 2017 Vermillion most likely:

选项:

A.experienced a decrease in overall efficiency.

B.improved its ability to estimate insured risks.

C.was more efficient in obtaining new premiums.

解释:

B is correct.

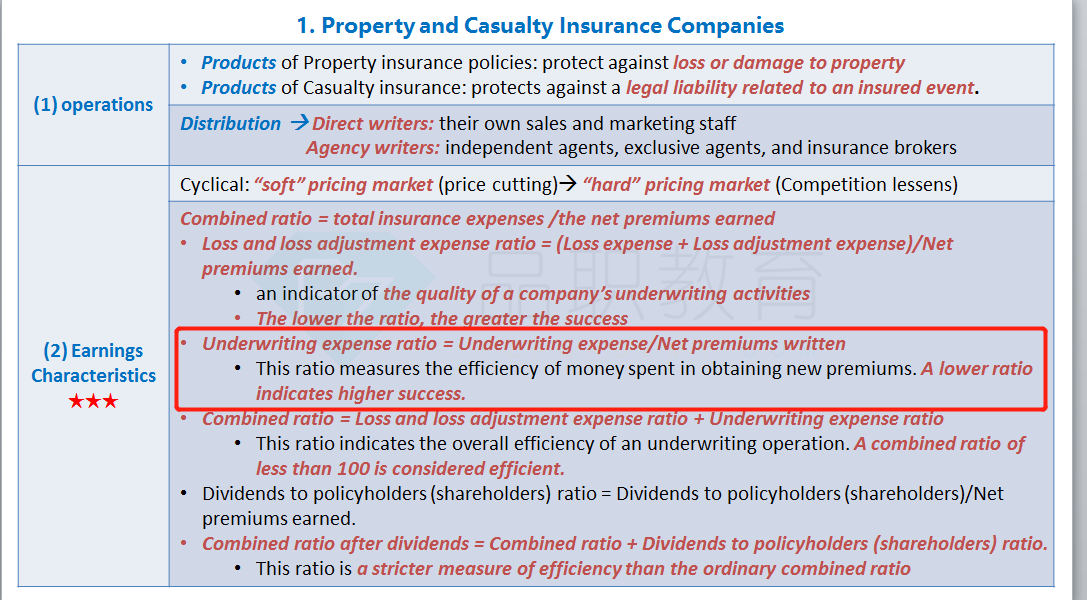

The loss and loss adjustment expense ratio decreased from 61.3% to 59.1% between 2016 and 2017. This ratio is calculated as follows: (Loss Expense + Loss Adjustment Expense)/Net Premiums Earned. The loss and loss adjustment expense ratio indicates the degree of success an underwriter has achieved in estimating the risks insured. A lower ratio indicates greater success in estimating insured risks.

请问一下c是什么意思 指的是哪个ratio