老师您好,我能理解【Foreign exchange gains arise because of the change in the exchange rate between the investor’s currency and the currency that the foreign shares are denominated in.】,但是我想不透下面这段原版书的例子。

题库有些关于ADR和汇率的问题,我常错,看了解析也一知半解,所以希望老师能说明下面三句话的言外之意到底是什么,谢谢老师!

------------------------------------------------

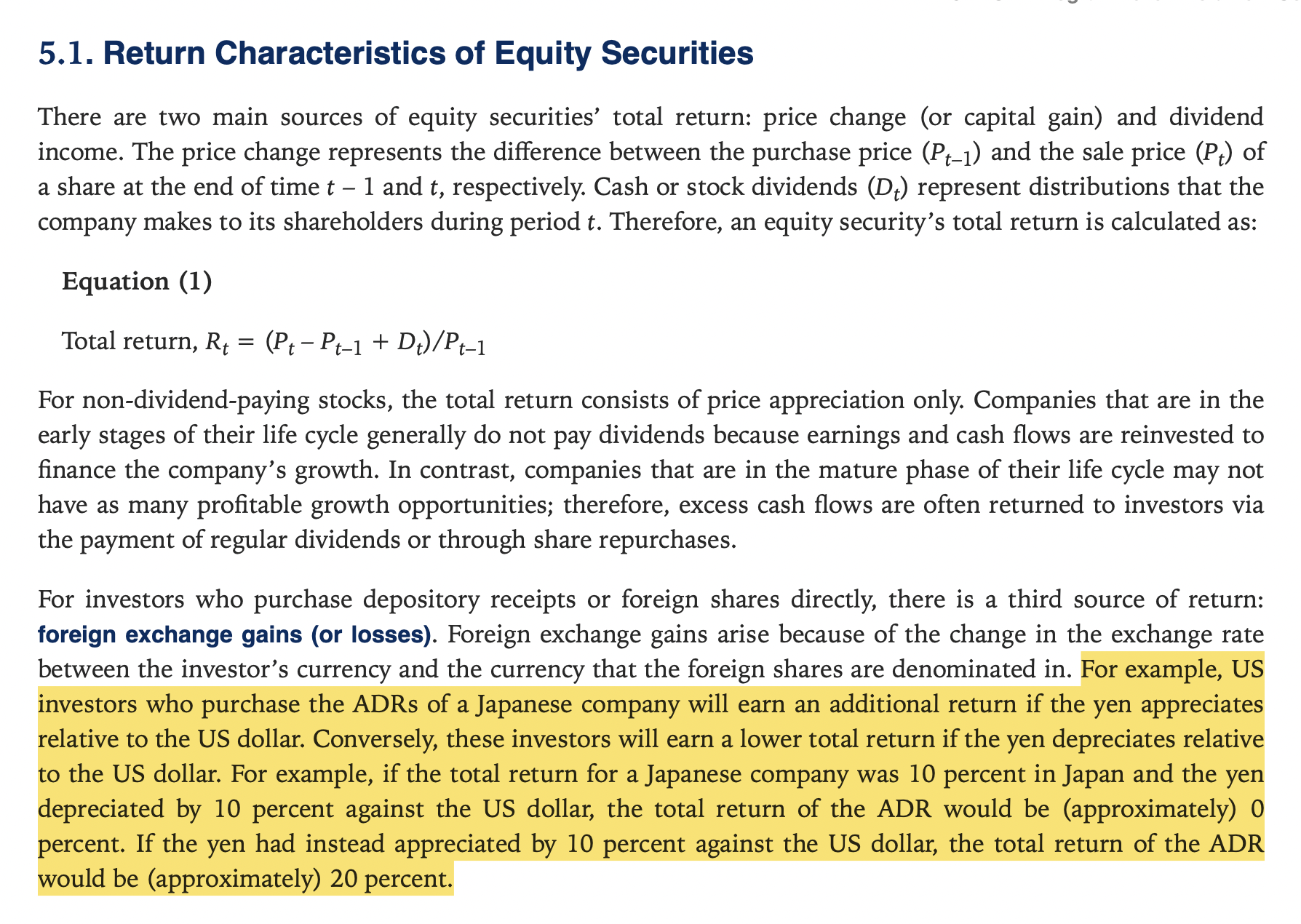

一:US investors who purchase the ADRs of a Japanese company will earn an additional return if the yen appreciates relative to the US dollar.

- 美国投资者买日本公司的ADR,这ADR以美元计价,日圆升值(即美元贬值),投资人为啥还能得到additional return?日圆变贵了,一美元可以买到的日圆变少了,怎么不是loss?

二:if the total return for a Japanese company was 10 percent in Japan and the yen depreciated by 10 percent against the US dollar, the total return of the ADR would be (approximately) 0 percent.

- 日本公司在日本的回报率是10%,日圆贬值+美元升值,我知道汇率的改变会影响美国ADR投资人的收益率,但ADR投资人的收益率怎么会被日圆贬值+美元升值的幅度给抵消?

三:If the yen had instead appreciated by 10 percent against the US dollar, the total return of the ADR would be (approximately) 20 percent.

- 日本公司在日本的回报率是10%,日圆升值+美元贬值,日圆变贵了,一美元可以买到的日圆变少了,怎么ADR投资人收益率不降反升?