NO.PZ201511190100001102

问题如下:

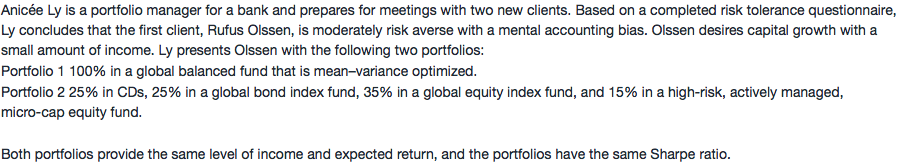

The second client, Verochka Calderón, gives Ly a list of the four highest-performing funds in her defined contribution plan and asks Ly to recommend an allocation. After Calderón completes a risk tolerance questionnaire, Ly determines that Calderón likely exhibits framing and regret biases. Using the four funds, Ly suggests two allocations, presented in Exhibit 1.

Determine, assuming Ly’s determination of Calderón’s biases is correct, which portfolio Calderón would most likely select.(circle one)

Allocation A

Allocation B

Justify your response.

选项:

解释:

Calderón would most likely select Allocation A.

● As a result of a framing bias, Calderón is likely to choose an allocation based on a 1/n naïve diversification strategy.

● As a result of a regret bias, Calderón is likely to choose a conditional 1/n strategy to minimize any potential future regret from one of her funds outperforming another.

Calderón would most likely select Allocation A. Ly believes that Calderón exhibits framing and regret biases. Framing bias may lead an investor such as Calderón to use a 1/n naïve diversification strategy, dividing contributions equally among available funds regardless of the underlying composition of the funds. Given Calderón’s selection of the four highest-performing funds in her plan, Calderón can minimize any potential future regret if one fund outperformed another by using a conditional 1/n diversification strategy, investing equally in all four funds. The Sharpe ratios of the two portfolios are the same, so this ratio does not influence the decision to select one allocation over the other.

请问这种题目回答的时候是否需要给投资者归类,例如PP,AA。。。