NO.PZ201812100100000606

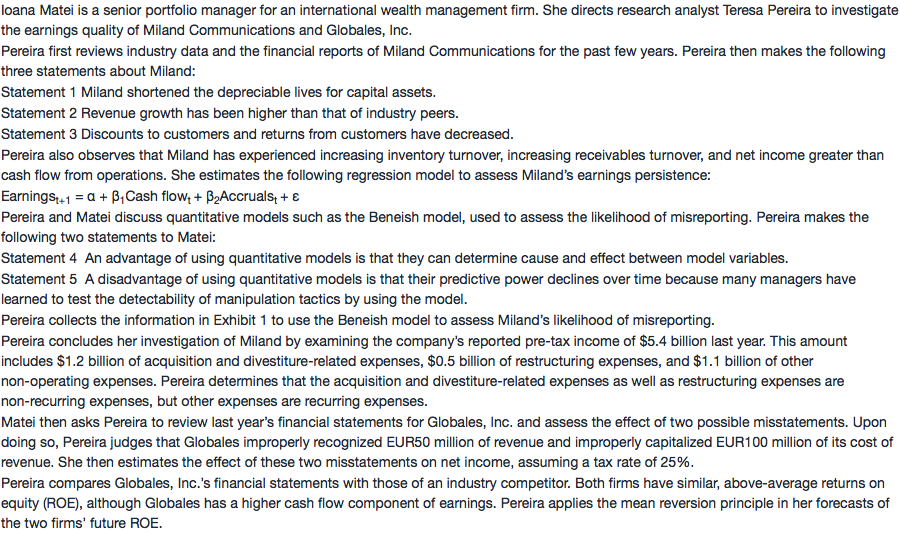

问题如下:

Based on Pereira’s determination of recurring and non-recurring expenses for Miland, the company’s recurring or core pre-tax earnings last year is closest to:

选项:

A.$4.3 billion.

B.$4.8 billion.

C.$7.1 billion.

解释:

C is correct.

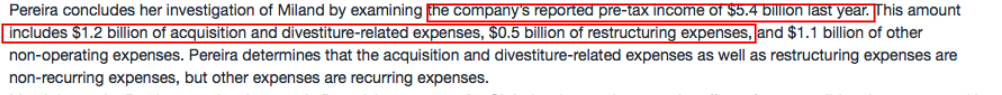

Recurring or core pre-tax earnings would be $7.1 billion, which is the company’s reported pre-tax income of $5.4 billion plus the $1.2 billion of non-recurring (i.e., one-time) acquisitions and divestiture expenses plus the $0.5 billion of non-recurring restructuring expenses.

解析:公司报告的税前收入是5.4 billion,这个数值已经扣掉了一些一次性支出:acquisition和divestiture支出是以后不会再发生的,因此计算recurring earning(持续稳定的,以后还会发生的)时要加回:recurring pre-tax earnings=5.4+1.2+0.5=7.1 billion。

既然earning的持续性是要排除non recurring ,为什么还要调整加回?

本来这个数5.4不就是排除掉non-recuring ,不是很懂,它调完了用在哪里,要怎么理解它非的加回来?