NO.PZ201812170100000206

问题如下:

Based on Statement 1, the net interest income for the three banks’ most likely will:

选项:

A.decrease.

remain unchanged.

increase.

解释:

A is correct.

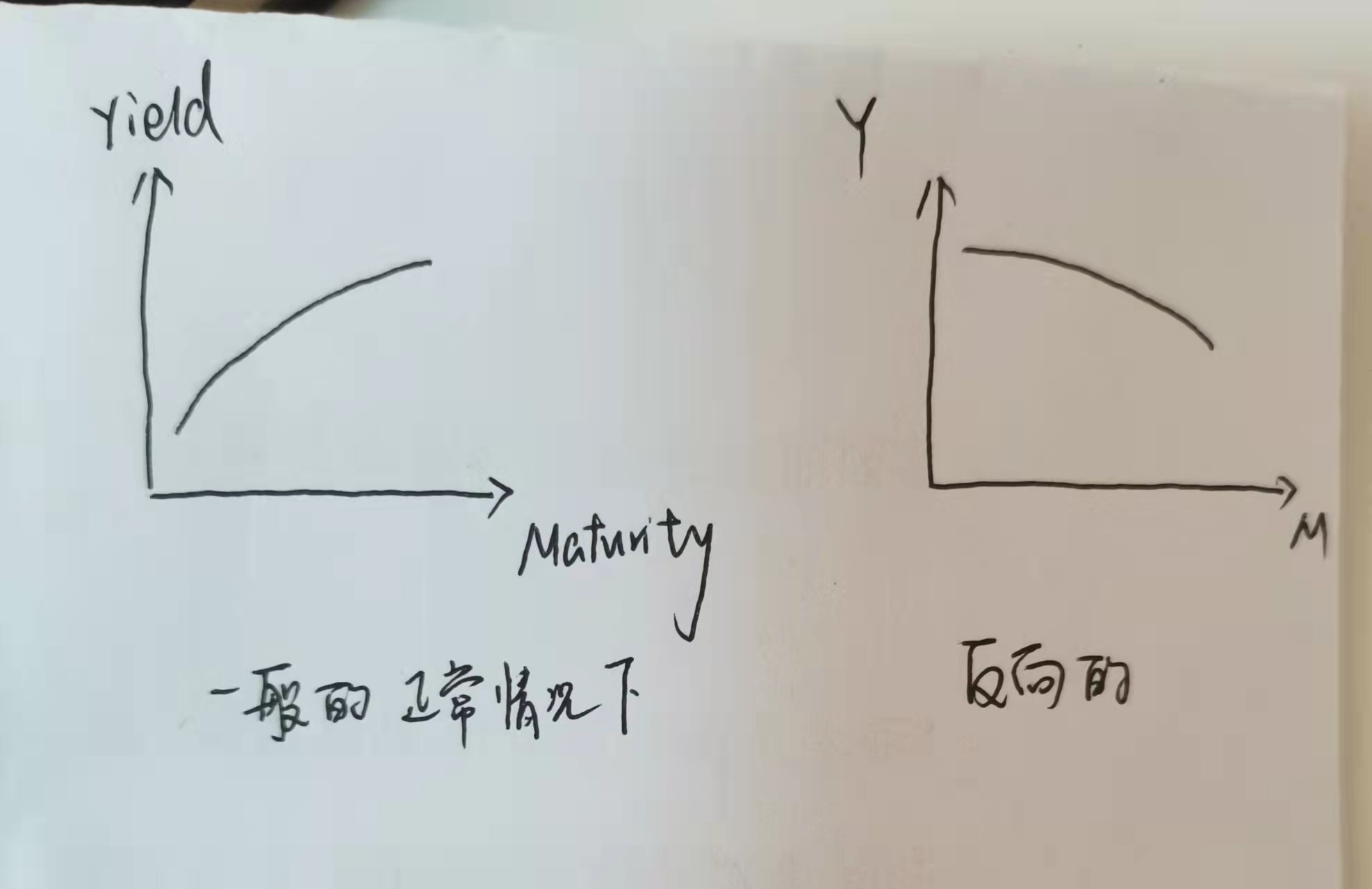

A bank’s net interest income represents the difference between interest earned on loans and other interest- bearing assets and the level of interest paid on deposits and other interest- bearing liabilities. Banks typically borrow money for shorter terms (retail deposits) and lend to customers for longer periods (mortgages and car loans). If the yield curve unexpectedly inverts, the short- term funding costs will increase and the net interest income will most likely decrease (not remain unchanged or increase).

解析:

考点:Analysis of Financial Institutions - Analyzing A Bank - The CAMELS Approach - Earnings

题目问基于描述 1,三家银行的 net interest income 将会如何变化?

解题的关键信息,位于 Exhibit 4 下面的一段及描述 1,共两部分文字。结合起来看,关键信息是想说:央行在解除货币宽松政策,隔夜拆解利率可能上升的不止 2 个点,可能上升更多,更说明短期利率上升,收益曲线反转,银行的负债成本上升了。

new interest income,等于资产的收益,减去负债的成本。后者上升了,所以结果是降低 decrease,选 A。

您好,收益曲线这个点和这个题目之间,我不记得了,您能画图解答一下吗?想不出来这个考点和逻辑。

(分析题目比计算题难多了)