NO.PZ2018111303000105

问题如下:

Edward, an analyst, is preparing a research report on the performance of W&M Inc. in last three years. He notes that:

1. Operating income has been much lower than operating cash flow (OCF)

2. The growth rate in revenue has exceeded the growth rate in receivables.

Do either of Notes 1 or 2 about W&M describe an accounting warning sign of a potential reporting problem?

选项:

A. No.

B. Yes,

Note 1 provides a warning sign.

C. Yes,

Note 2 provides a warning sign.

解释:

A is correct.

Note1和2都不是warning sign。

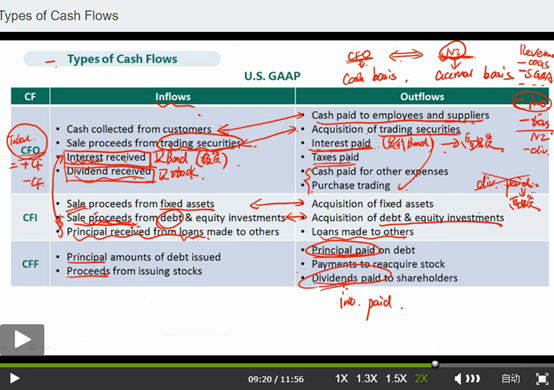

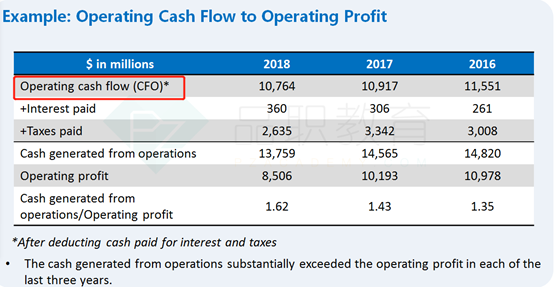

Note1说operating income比OCF小很多,说明公司收到的现金流高于损益表里权责发生制计的收入,意味着公司内部收到了更多的现金流,但是暂时还没有确认收入,那么报表计的比较谨慎,没有虚增利润,所以不是一个warning sign。如果反过来,operating income比operating cash flow大,那么就是warning sign。

Note2说销售额的增长大于AR的增长,说明销售额的增长更多的是赚到了实实在在的现金流,因此不是一个warning sign。如果反过来,销售额的增长小于AR的增长,说明新增的大部分销售额都是没有收现的,说明销售额是不可持续的,则是一个warning sign。

operating income 和ocf公式分别是什么