NO.PZ201602060100001002

问题如下:

NinMount’s long-term debt to equity ratio on 31 December 2018 most likely will be lowest if the results of the acquisition are reported using:

选项:

A.the equity method.

B.consolidation with full goodwill.

C.consolidation with partial goodwill.

解释:

A is correct.

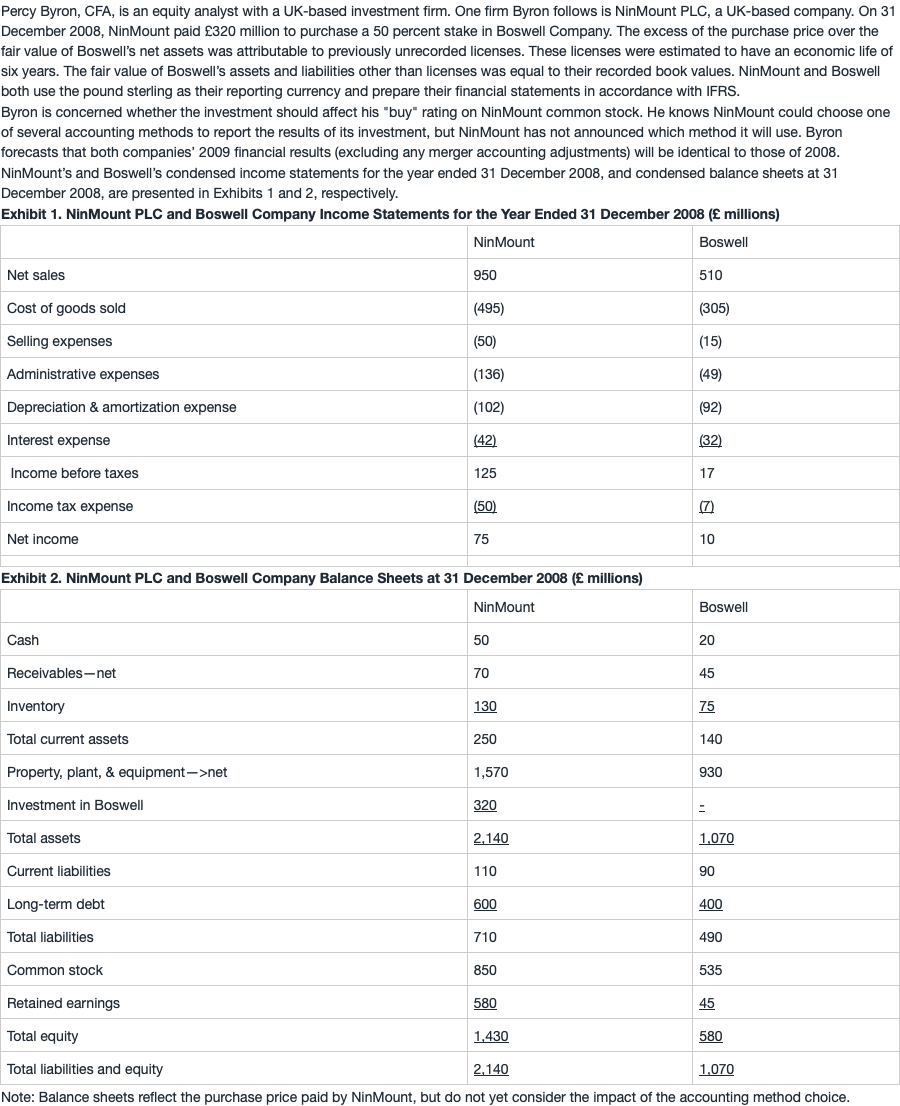

Using the equity method, long-term debt to equity = £600/£1,430 = 0.42. Using the consolidation method, long-term debt to equity = long-term debt/equity = £1,000/£1,750 = 0.57. Equity includes the £320 noncontrolling interest under either consolidation. It does not matter if the full or partial goodwill method is used since there is no goodwill.

考点 : 不同的会计方法对财务比率的影响

解析 :

2018年末也就是投资发生的时点。equity method是one-line consolidation,只在投资公司的资产中增加一项investment in associate,cash减少相同金额。不对被投资公司的资产和负债进行合并。如果使用equity method,直接用NinMoun自己的debt和equity相除:long-term debt to equity= £600/£1,430 = 0.42

如果使用consolidation method,因为百分百合并了子公司的资产和负债,但其实只支付了50%投资比例所对应的cash,因此资产端会多一块,需要在母公司equity里增加MI(Minority interest)来调平。equity=£1,430+320(MI )=£1,750

long-term debt to equity=(£600+£400)/£1,750 = 0.57

※ 计算MI的方法:

MI计算公式有两个,分别对应full goodwill method和partial goodwill method,但本案例中没有产生goodwill(具体原因可以看上一小问的解析),因此不管是full goodwill method还是partial

goodwill

method,两种计量方法得到的MI相同。换句话说,只有在存在goodwill的情况下,不同goodwill计量方法下的MI才有区别。从计算公式来看:

full goodwill method下:MI =(acquisition cost / % of interests acquired) × (% of non-controlling interest)

partial goodwill method下:MI = FV of net identifiable assets × (% of non-controlling interest)

本题中没有goodwill,acquisition cost/% of interests acquired=FV of net identifiable assets=320/50%=640,MI=640×50%=320。两种方法计算的MI相同。从这个角度思考的话可以直接排除BC,因为两个选项没有区别。

NO.PZ201602060100001002

问题如下:

NinMount’s long-term debt to equity ratio on 31 December 2018 most likely will be lowest if the results of the acquisition are reported using:

选项:

A.

the equity method.

B.

consolidation with full goodwill.

C.

consolidation with partial goodwill.

解释:

A is correct.

Using the equity method, long-term debt to equity = £600/£1,430 = 0.42. Using the consolidation method, long-term debt to equity = long-term debt/equity = £1,000/£1,750 = 0.57. Equity includes the £320 noncontrolling interest under either consolidation. It does not matter if the full or partial goodwill method is used since there is no goodwill.

考点 : 不同的会计方法对财务比率的影响

请问为什么求equity只加了MI?

母公司本身拥有的股权320已经体现在自己的报表中了吗?

不是没有确定用什么样的方法合并报表吗?