NO.PZ2019012201000047

问题如下:

Laubach states that the board is interested in following a passive approach for some or all of the

equity allocation. In addition, the board is open to approaches that could

generate returns in excess of the benchmark for part of the equity allocation.

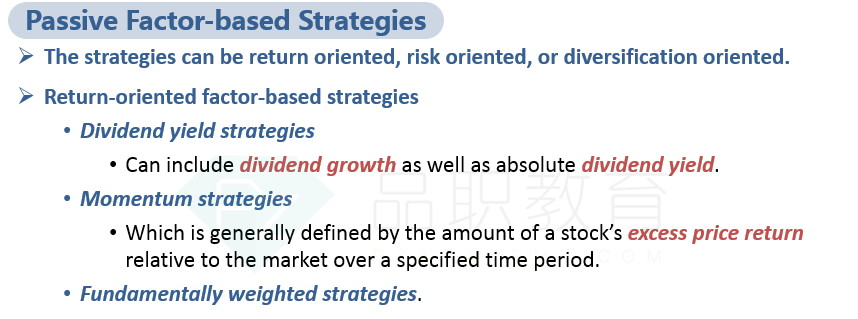

McMahon suggests that the board consider following a passive factor-based

momentum strategy for the allocation to international stocks.

The international

strategy suggested by McMahon is most likely characterized as:

选项:

A.risk based

return oriented

diversification oriented

解释:

McMahon suggests

that the foundation follow a passive factor-based momentum strategy, which is

generally defined by the amount of a stock’s excess price return relative to

the market during a specified period. Factor-based momentum strategies are

classified as return oriented.

能不能把这三种对应的策略都总结下,谢谢