NO.PZ2016082402000031

问题如下:

An investor sells a June 2008 call of ABC Limited with a strike price of USD 45 for USD 3 and buys a June 2008 call of ABC Limited with a strike price of USD 40 for USD 5. What is the name of this strategy and the maximum profit and loss the investor could incur?

选项:

A.Bear spread, maximum loss USD 2, maximum profit USD 3

B.Bull spread, maximum loss unlimited, maximum profit USD 3

C.Bear spread, maximum loss USD 2, maximum profit unlimited

D.Bull spread, maximum loss USD 2, maximum profit USD 3

解释:

ANSWER: D

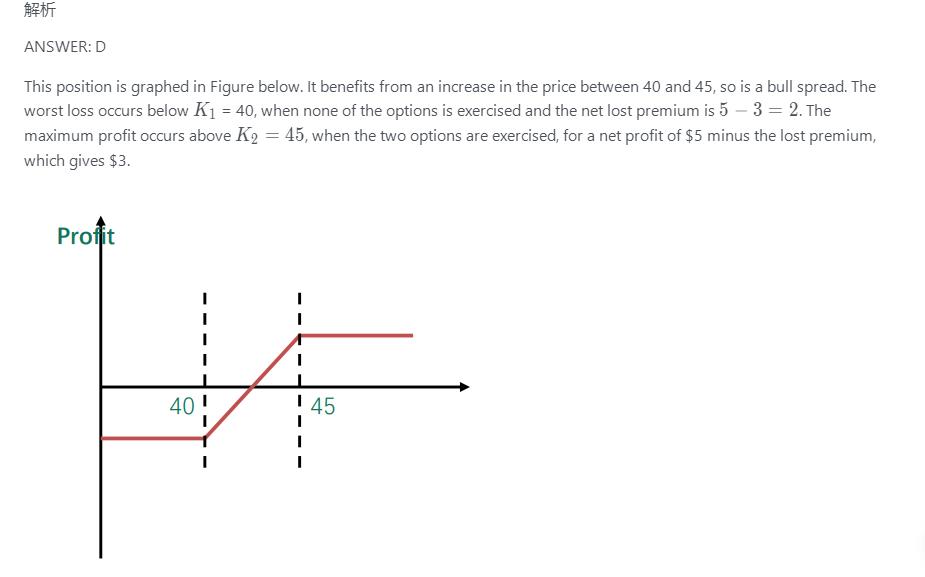

This position is graphed in Figure below. It benefits from an increase in the price between 40 and 45, so is a bull spread. The worst loss occurs below = 40, when none of the options is exercised and the net lost premium is . The maximum profit occurs above , when the two options are exercised, for a net profit of $5 minus the lost premium, which gives $3.

看不到图片