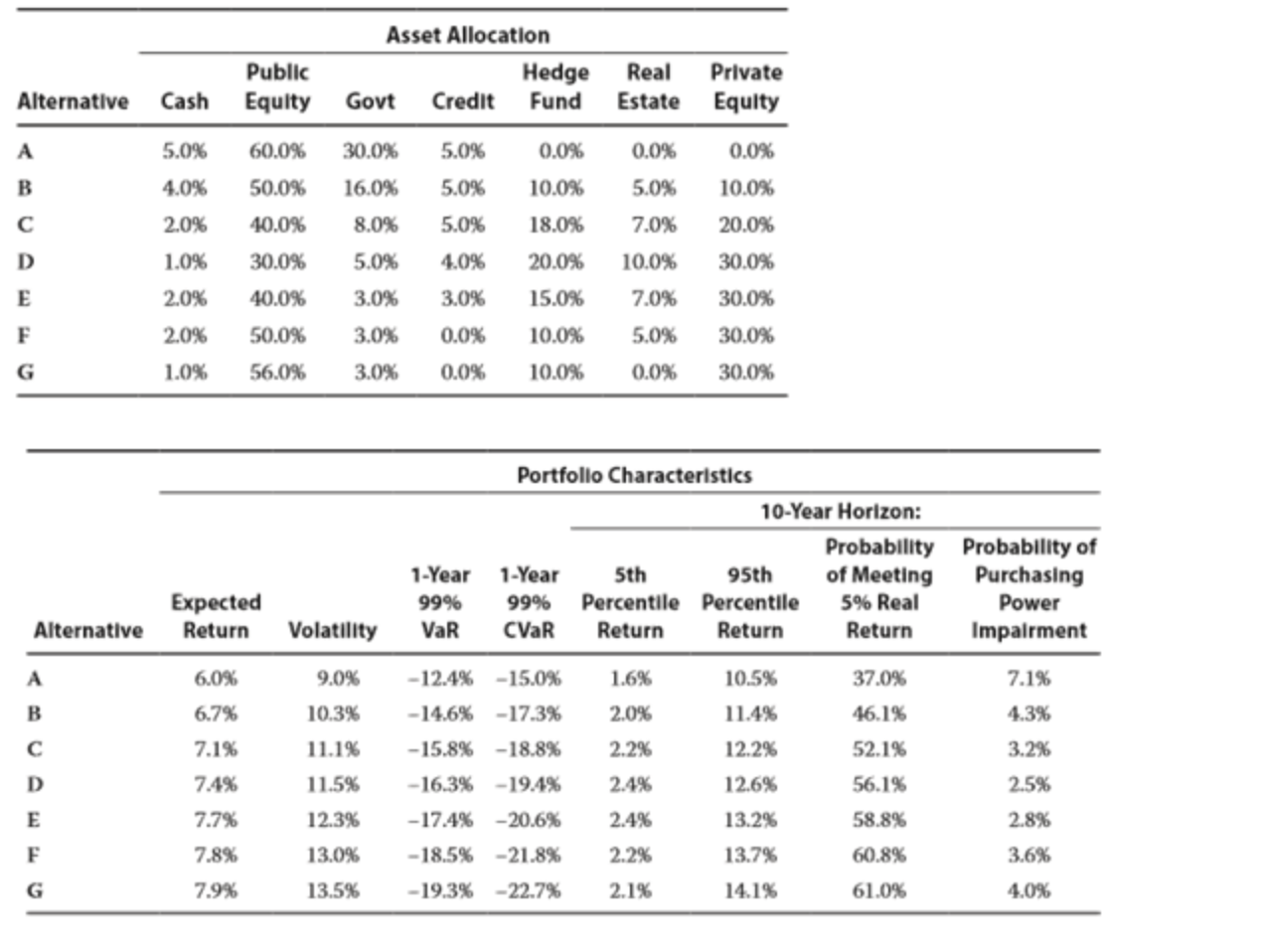

The CIO (chief investment officer) of the International University Endowment Fund (the Fund) is preparing for the upcoming investment committee (IC) meeting. The Fund’s annual asset allocation review is on the agenda, and the CIO plans to propose a new strategic asset allocation for the Fund. Subject to prudent risk- taking, the recommended asset allocation should offer

• the highest expected return and

• the highest probability of achieving the long- term 5% real return target.

• The inflation assumption is 2%.

In addition, the risk in the Fund is one factor that is considered when lenders assign a risk rating to the university. The university’s primary lender has proposed a loan covenant that would trigger a re- evaluation of the university’s creditworthiness if the Fund incurs a loss greater than 20% over any 1- year period.

The investment staff produced the following tables to help the CIO prepare for the meeting.

Which asset allocation is most likely to meet the committee’s objective and constraints?