NO.PZ2021091701000033

问题如下:

Fran McClure of Alba Advisers is estimating the cost of capital of Frontier

Corporation as part of her valuation analysis of Frontier. McClure will be using

this estimate, along with projected cash flows from Frontier's new projects, to

estimate the effect of these new projects on the value of Frontier. McClure has

gathered the following information on Frontier Corporation:

The weights that McClure should apply in estimating Frontier’s cost of capital

for debt and equity are, respectively:

选项:

A.wd = 0.200; we = 0.800.

wd = 0.185; we = 0.815.

wd = 0.223; we = 0.777

解释:

C is correct.

wd = $63/($220 + 63) = 0.223.

we = $220/($220 + 63) = 0.777.

Market values should be used in cost of capital calculations, and forecasted

market values should be used in this case given that the cost of capital will be

applied to projected cash flows in McClure’s analysis.

老师好,

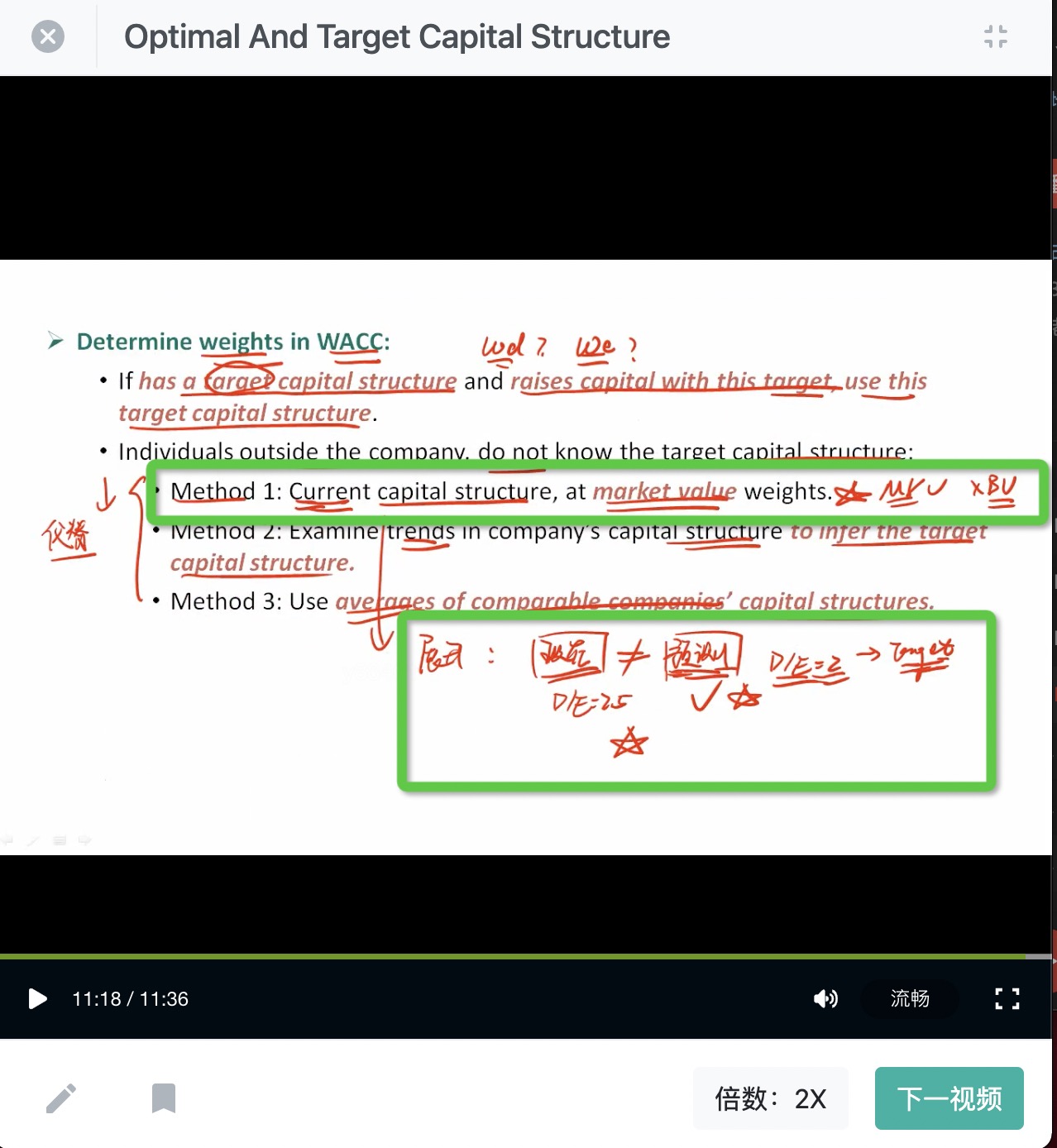

1)我记得课上说计算目标资本结构要用book value,计算wacc和最优资本结构时用market value,这题怎么从题目分辨呢?

2)另外,如何看出是要用forecasted值呢?

谢谢。