1、No.PZ202105200100002701

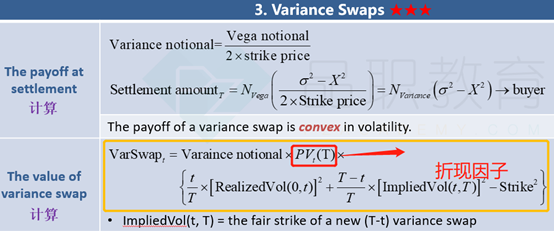

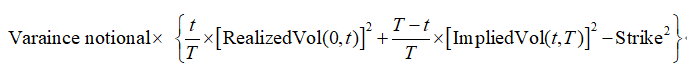

PVt(T) = 1/[1 + (2.5% × 6/12)] = 0.987654 (= Present Value Interest Factor for six months, where the annual rate is 2.5%).

这一步的计算过程,老师否可解释一下?为什么要折现

2、No.PZ2021052101000028 (选择题)

Hirji considers the scenario where the yield curve will lose curvature for the Malaysian institutional client. She notes that a 7-year Canadian government bond is also available in the market. Hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds and 53% in 7-year bonds.

Relative to the Canadian government bond index, the portfolio that Hirji proposes for the Malaysian client will most likely:

为什么后来proposed 更bullet,不是更分散吗?分散不是barbell吗

3、No.PZ2021052101000033 (选择题)

Dynamo uses a bottom-up approach that selects bonds with the best relative value from the universe of bonds with similar characteristics. Which of the following is most likely to be used when selecting securities based on Dynamo’s credit strategy approach?

C呢

这一部分,计算的就是到T时刻的value(只是0-T这段时间分为了0-t和t-T这样两段而已),所以需要往前折现后才是我们要求的t时刻的value。

这一部分,计算的就是到T时刻的value(只是0-T这段时间分为了0-t和t-T这样两段而已),所以需要往前折现后才是我们要求的t时刻的value。