来源: PZ202105210200000

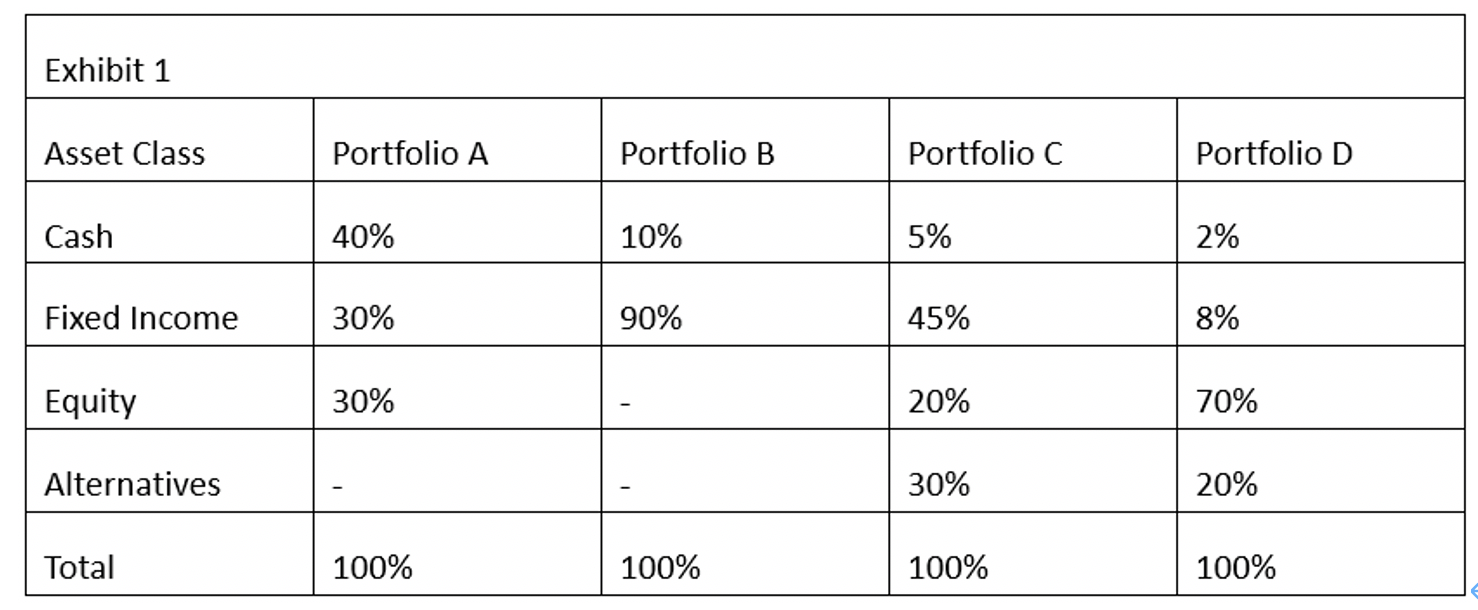

After success working with Whatsit Widgets, Stuart has been called to help with the Pension Reserves fund of the Commonwealth of Massachusetts. Presently, the plan is overfunded. There are no liquidity requirements at this time, and none expected for many years. Stuart considers the four portfolios shown in Exhibit 1.

为什么不选C,

I think the portfolio C is the most proper. Since the plan is overfunded and has no liquidity requirements at this time, and none expected for many years, the plan can bear some risks to gain higher return. So we needs to have some allocation to the alternatives to gain higher returns. (return generating)

But since the pension plan needs to cover the needs of retirement, so it needs some stable investments such as fixed income, so the main allocation should be the fixed income, which can maintain the fund status.(hedging)