NO.PZ2019012201000079

问题如下:

Which of following is correct regarding on Implementation Constraints?

选项:

A. Twice the absolute risk will lead to twice the return.

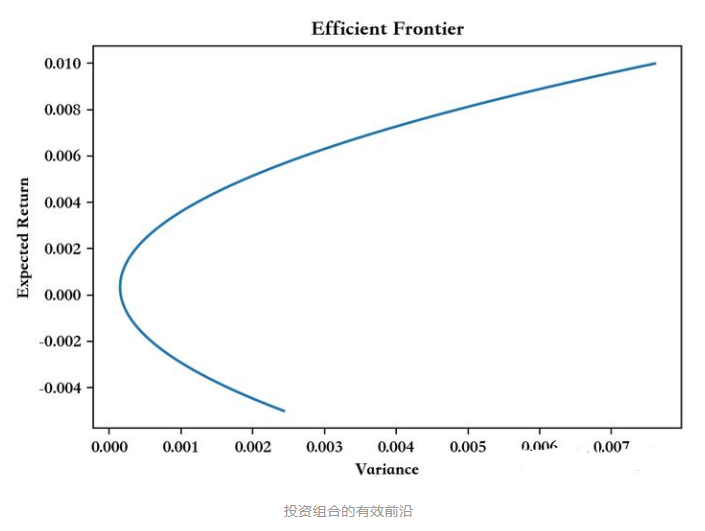

B. Markowitz efficient frontier shows that the relationship between return and risk is convex.

C. There is a level of leverage beyond which volatility reduces expected returns.

解释:

C is corrent. Portfolios may face implementation constraints that decrease the IR if active risk increases beyond a specific level; Portfolios with high absolute risk targets face limited diversification opportunities, which may lead to a decrease in the SR. There is a level of leverage beyond which volatility reduces expected returns.

主要是说当杠杆过高,虽然可能会带来收益,但是风险也会增加,带来更大的波动,反而会降低收益。打个比方,昨天跌了10%,今天涨了10%,看起来好像是一样的。但是实际不是一回事,反而是亏损的(亏损1%),加杠杆后会进一步降低收益。

There may be constraints that prevent Manager A from scaling his active weights.So twice the absolute risk will not lead to twice the return, Markowitz efficient frontier shows that the relationship between return and risk is concave.

B选项怎么理解。。。。。。。