NO.PZ2018113001000003

问题如下:

A $100 million pension fund with 80% stock and 20% bond. The beta of equity portion is 1.2 and the duration of bond portion is 5.0. In order to adjust the allocation to 60% stock and 40% bond, the number of stock index futures needed to sell is? Based on the following information:

- The stock index value is at 1,200, multiplier is $250, the beta is 0.95

- The price of bond futures contract is $105,300 with an implied modified duration of 6.5.

选项:

A.-88

B.-84

C.-95

解释:

B is correct.

考点:用futures contract 调整组合的头寸

解析:

现需要将股票头寸从80%降至60%,即需要将20%*100,000,000=$20,000,000的股票的beta调整为0(转成cash)

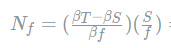

需要的stock index futures contract数量为:

因此,需要卖出84份股票期货合约。

做出来答案没问题,想确认一下解释