NO.PZ2019122802000036

问题如下:

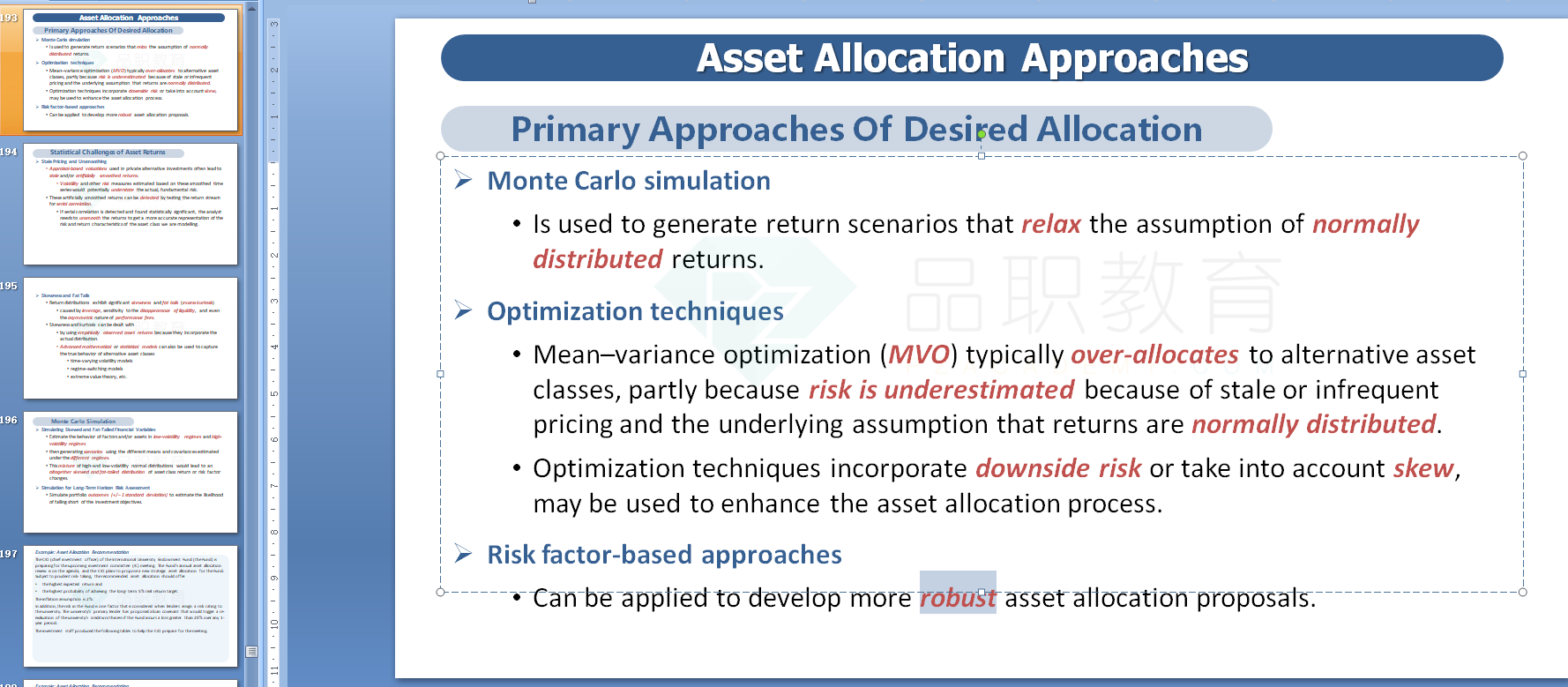

Which of the following statement about Monte Carlo Simulation in alternative asset allocation is not correct?

选项:

A.Monte Carlo Simulation relaxes the assumption of normally distributed return.

Monte Carlo Simulation combines the high and low volatility normal distributions to lead a skewed and fat-tailed distribution for alternative investments.

Monte Carlo Simulation is the most robust asset allocation approach.

解释:

C is correct.

Risk-factor based optimization is the most robust asset allocation approach.

蒙特卡洛模拟来做另类的资产配置的时候,核心的目标是去模拟一个skewed and fat-tailed 收益与风险的分布;具体方法是这三步:

确定low-volatility 以及 high-volatility两种情况下的风险因子,确定好之后,用蒙特卡洛模拟建议不同情况下的收益模型,然后再把这个不同情况下的收益模型叠加起来,就能构建一个skewed and fat-tailed模型,这样就符合另类投资的收益风险特征了。

这是讲义当中写的具体步骤哈:

•Estimate the behavior of factors and/or assets in low-volatility regimes and high-volatility regimes

•then generating scenarios using the different means and covariances estimated under the different regimes.

•This mixture of high-and low-volatility normal distributions would lead to an altogether skewed and fat-tailed distribution of asset class return or risk factor changes.

麻烦老师描述一下Risk factor based Optimization是怎么做的,没听懂李老师讲的这个第三种方法。