NO.PZ201809170400000104

问题如下:

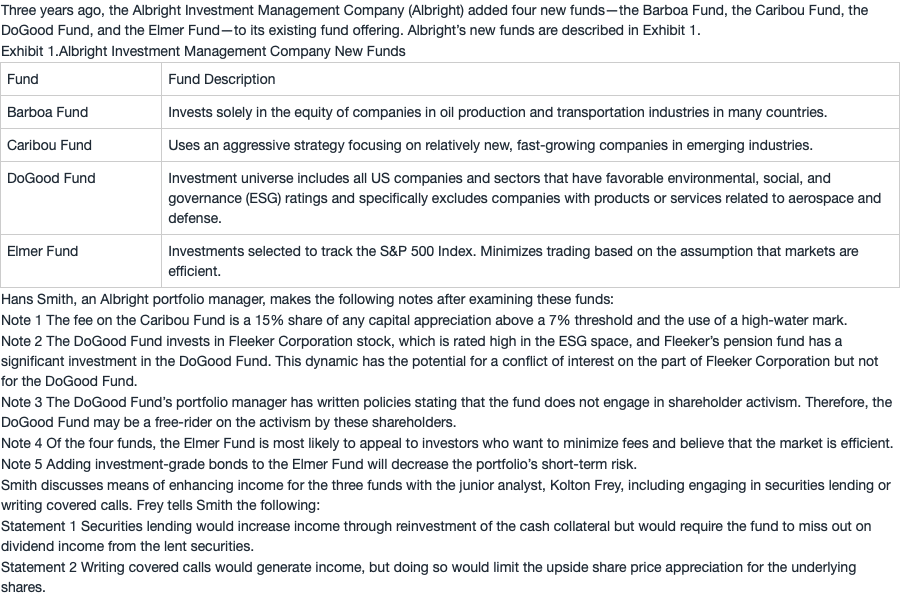

The Elmer fund’s management strategy is:

选项:

A.active.

B.passive.

C.blended.

解释:

B is correct. The fund is managed assuming that the market is efficient, and investments are selected to mimic an index. Compared with active strategies, passive strategies generally have lower turnover and generate a higher percentage of long-term gains. An index fund that replicates its benchmark can have minimal rebalancing.

如果是被动投资,要跟踪benchmarrk,那不是应该会有很多rebalance么,要保持一致,cost会高之类的(类似于fix里面liability-based approach)