NO.PZ201511190100000401

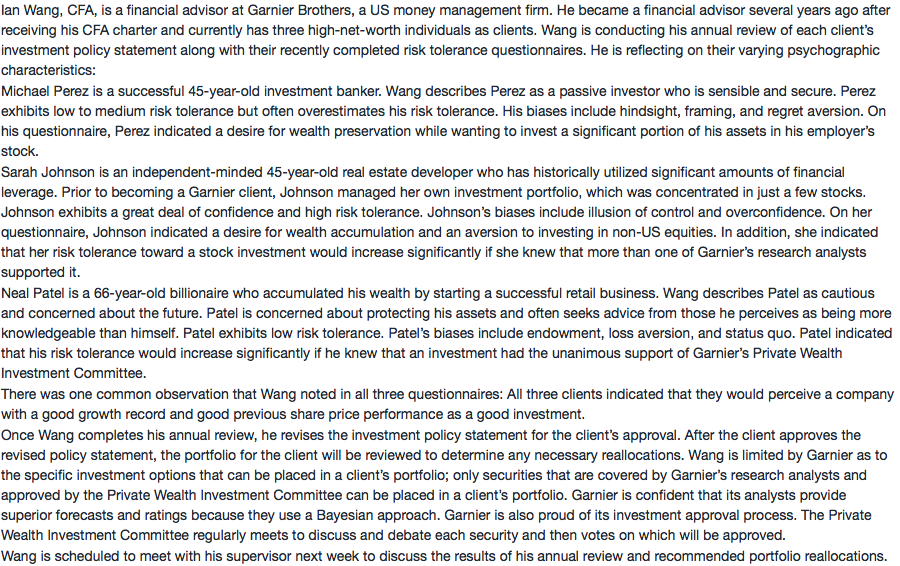

问题如下:

When advising his clients, Wang is least likely to:

选项:

A.educate Perez on the benefits on portfolio diversification.

B.limit Johnson’s role in the investment decision-making process.

C.provide Patel with details like standard deviations and Sharpe ratios.

解释:

C is correct.

This would not be an effective way to advise Patel. Given Patel’s information, he is likely to be more receptive to “big picture” advice that does not dwell on details like standard deviations and Sharpe ratios. He is emotionally biased and providing excessive cognitive detail will lose his attention. He needs to be convinced of his advisor’s general philosophy first and then, as trust is gained, he will respond to advice and take action. (Patel is a Passive Preserver.)

1)这个问题中第三个人petal虽然说他risk tolerance是low,但又说他是创业的,所以收入是active的,所以不应该是AA么?这里是不是有点矛盾?那这种条件矛盾要怎么选择?

2)还有这个题目哪里暗示要用Pompian Behavior Model分析?为什么不能用BB&K Model?所以遇到这种分析客户的题目到底要用哪个模型分析?

3)这个问题中没有II,如果有II,那和FF要怎么区分?对于II需要提供什么建议?

谢谢