The mandate of Pool 2 also consists of two primary goals:

- A goal that the overall stock portfolio should consist of mature companies that have stable net incomes and high dividend yields

- A goal of expressing strong views on many major corporate issues through proxy voting

Q. Which of the following index methodologies is most appropriate to use as a benchmark for the overall stock portfolio described in Pool 2?

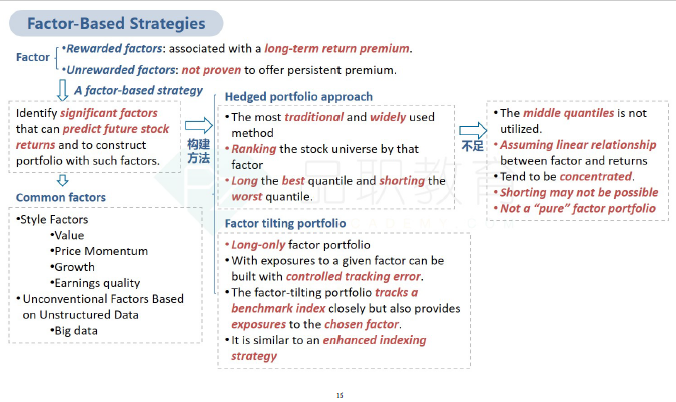

- Factor based

- Capitalization weighted

- Fundamentally weighted

想问下如何区别factor based 和fundamental weighted?