NO.PZ2015121810000012

问题如下:

What is the maximum Sharpe ratio that a manager can achieve by combining the S&P 500 benchmark portfolio and the Indigo Fund?

选项:

A.0.333

B.0.365

C.0.448

解释:

B is correct.

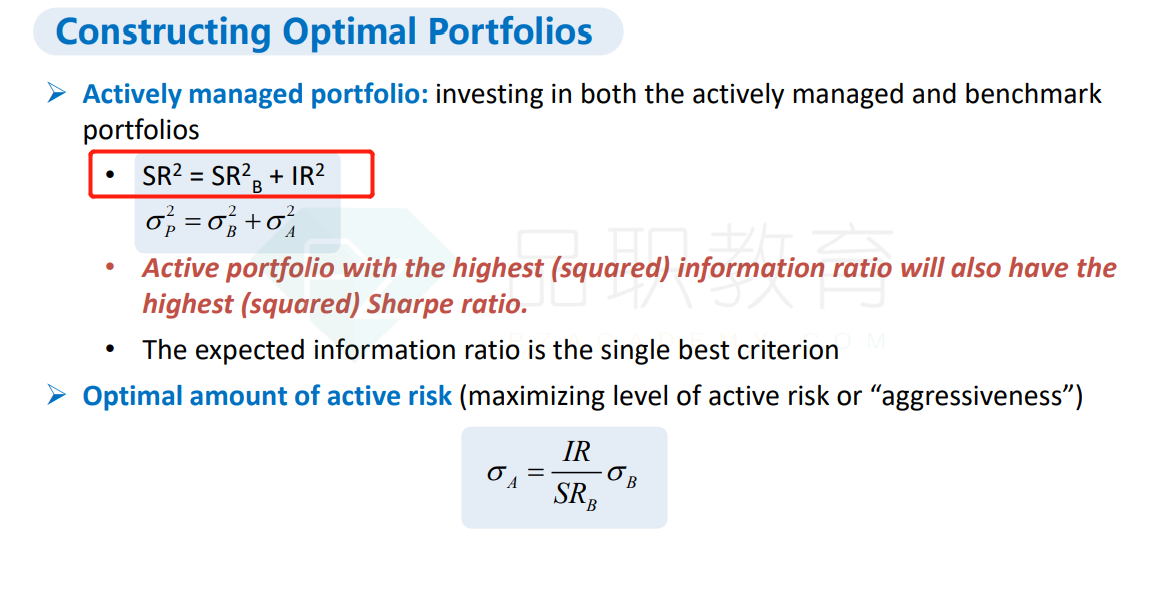

The highest squared Sharpe ratio of an actively managed portfolio is:

{$table2}The highest Sharpe ratio is

{$table3}考点:Sharpe ratio

解析: 求得是Indigo Fund与benchmark组合后的maximum Sharpe ratio。由于combined portfolio的IR不受激进程度的影响,因此无论当前的active risk是否处于optimal amount,IR的值不变。代入公式:

因此,SR=0.365。

SR²=SRB²+IR²,这个公式在强化串讲里没提到过啊,这个公式的原理是什么?