NO.PZ2017121101000008

问题如下:

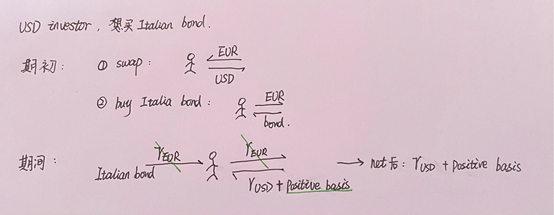

A US institutional investor in search of yield decides to buy Italian government bonds for her portfolio but wants to hedge against the risk of exchange rate fluctuations. She enters a cross-currency basis swap, with the same payment dates as the bonds, where at inception she delivers US dollars in exchange for euros for use in purchasing the Italian bonds.

Assume demand for US dollars is strong relative to demand for euros, so there is a positive basis for “lending” US dollars. By hedging the position in Italian government bonds with the currency basis swap, the US investor will most likely increase the periodic net interest payments received from the swap counterparty in:

选项:

A.euros only.

US dollars only.

both euros and US dollars.

解释:

B is correct.

By hedging the position in Italian government bonds with the cross-currency basis swap, the US investor will most likely increase the periodic net interest she receives in US dollars. The reason is that the periodic net interest payments made by the swap counterparty to the investor will include the positive basis resulting from the relatively strong demand for US dollars versus euros.

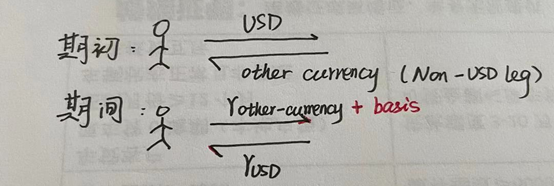

你好,教材中提到(上面),basis是quoted on non-USD leg。但是题目中的Basis是跟在了USD后面。

首先,可以解释为是跟着EUR的话negative basis么?

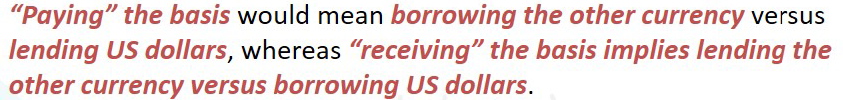

另外,这种情况下,仍然是paying the basis么 (如下面解释)?

跟进一步,pay/receive basis与basis的正负有没有关系?