NO.PZ2020012001000035

问题如下:

The standard deviation of quarterly (three-month) changes in the price of a commodity is 80 cents, and the standard deviation of quarterly changes in the futures price of a related commodity is 90 cents. The correlation between the two changes is 0.81.

The amount of the commodity being hedged is 200,000 units, and one futures contract is on 5,000 units of the commodity. How many contracts should be used in hedging? (Round to the nearest whole number.)

解释:

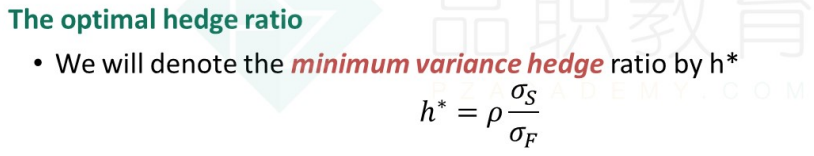

The optimal hedge ratio is 0.72.

The number of contracts is

0.72 *200,000/5,000= 28.8

or 29, when rounded to the nearest whole number.

这道题0.72是怎么算的