NO.PZ201812020100000101

问题如下:

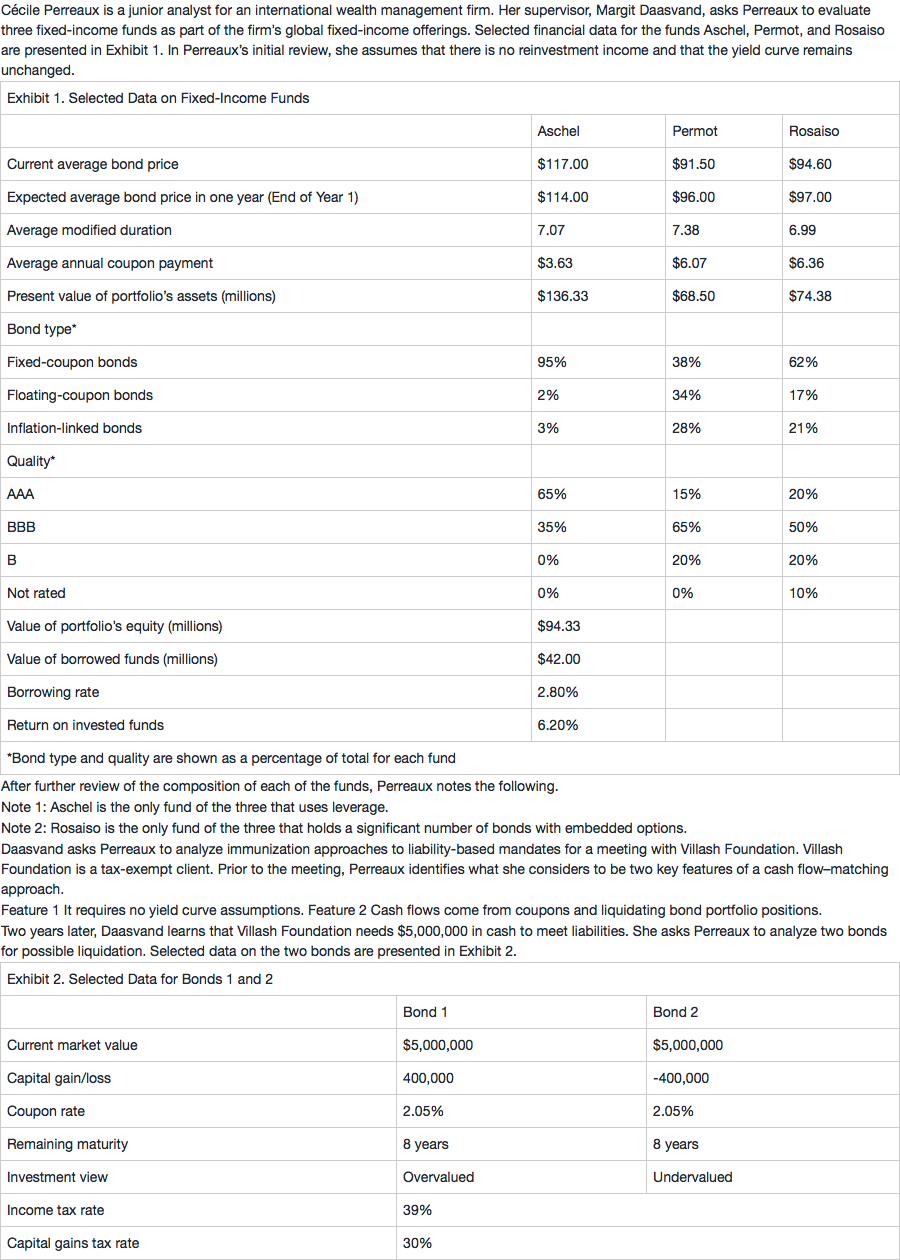

Based on Exhibit 1, which fund provides the highest level of protection against inflation for coupon payments?

选项:

A.Aschel

B.Permot

C.Rosaiso

解释:

B is correct.

Permot has the highest percentage of floating-coupon bonds and inflation-linked bonds. Bonds with floating coupons protect interest income from inflation because the reference rate should adjust for inflation. Inflation-linked bonds protect against inflation by paying a return that is directly linked to an index of consumer prices and adjusting the principal for inflation. Inflation-linked bonds protect both coupon and principal payments against inflation.

The level of inflation protection for coupons = portfolio in floating-coupon bonds% + portfolio in inflation-linked bonds%: Aschel = 2% + 3% = 5%

Permot = 34% + 28% = 62%

Rosaiso = 17% + 21% = 38% Thus, Permot has the highest level of inflation protection with 62% of its portfolio in floating-coupon and inflation-linked bonds.

有问必答如何使用