NO.PZ2020011303000087

问题如下:

Suppose that the price of asset X at the close of trading yesterday was USD 40 and its volatility was then estimated as 1.5% per day. Suppose further that the price of asset Y at the close of trading yesterday was USD 10 and its volatility was then estimated as 1.7%per day. The price of X and Y at the close of trading today are USD 38 and USD 10.1, respectively. The correlation between X and Y was estimated as 0.4 at the close of trading yesterday. Update the volatility of X and Y and the correlation between X and Y using the EWMA model with λ equal to 0.95.

选项:

解释:

The new estimates of the variance rate of X is

0.95 × 0.015^2 + 0.05 × (−2/40)^2 = 0.000339

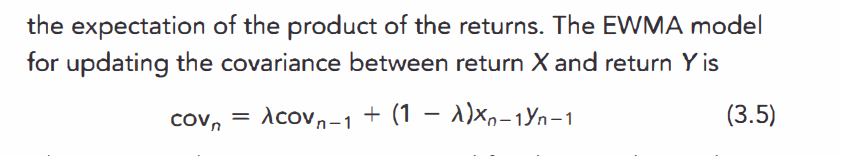

which corresponds to a new volatility of 1.84%. The new volatility for Y is1.67%. The covariance yesterday was 0.015 × 0.017 × 0.4 = 0.000102. The new covariance is

0.95 × 0.000102 + 0.05 × (−2/40) × (0.1/10) = 0.0000719

The new correlation is 0.0000719/(0.0184 × 0.0167) = 0.23.

请问考试new covariance的公式会考么?这个在考纲里么?上课似乎没讲吧