NO.PZ2016070201000051

问题如下:

If a trader is creating a fixed income hedge, which hedging methodology would be least effective if the trader is concerned about the dispersion of the change in the nominal yield for a particular change in the real yield?

选项:

A.One-variable regression hedge.

B.DV01 hedge.

C.Two-variable regression hedge.

D.Principal components hedge.

解释:

The DV0l hedge assumes that the yield on the bond and the assumed hedging instruments rises and falls by the same number of basis points; so with a DV01 hedge, there is not much the trader can do to allow for dispersion between nominal and real yields.

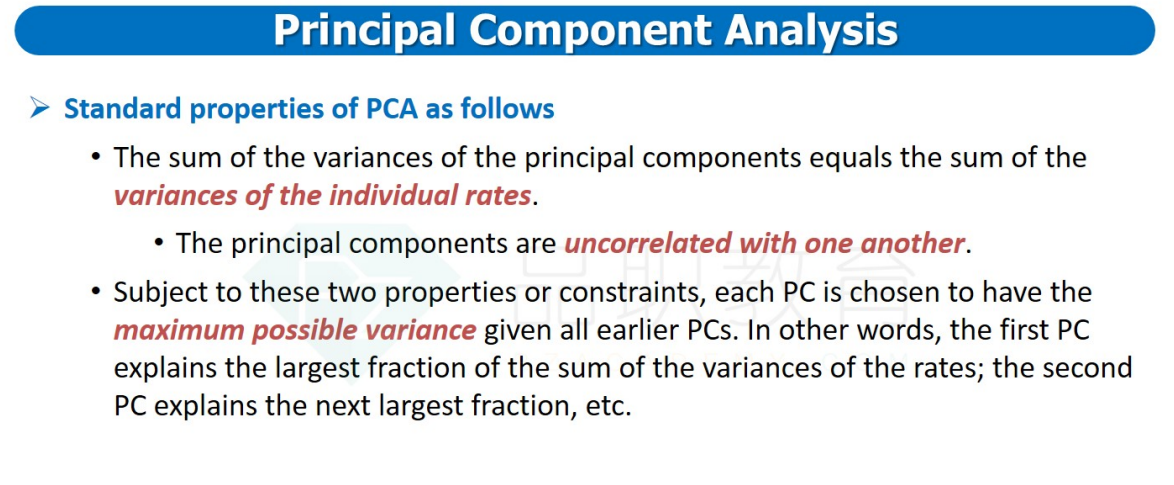

D principal component hedge 是什么?