NO.PZ2019012201000071

问题如下:

Which fund manager’s investing approach is most consistent with fundamental management?

选项:

A.Furlings

Asgard

Tokra

解释:

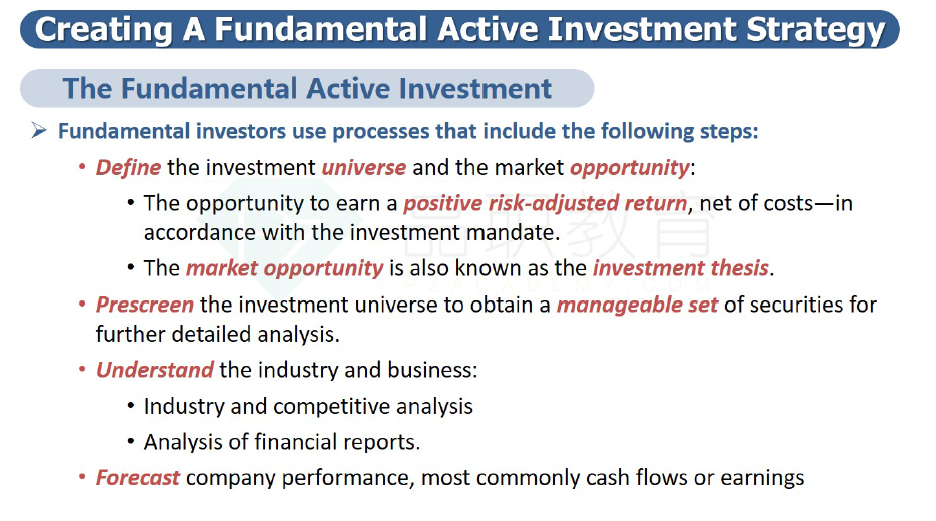

A is correct. Furlings combines a top-down and bottom-up approach, but in both cases, the allocation process is signifcantly determined according to the managers’ discretion and judgement. There is a strong emphasis on understanding fnancial reporting, and the sector managers focus on a relatively small number for frms. They also extend their analysis to other areas associated with fundamental management, such as valuation, competitive advantages, and governance. Finally, Furlings’s top-down process depends largely on the views and experience of its head manager.

为什么C不对