NO.PZ2019012201000013

问题如下:

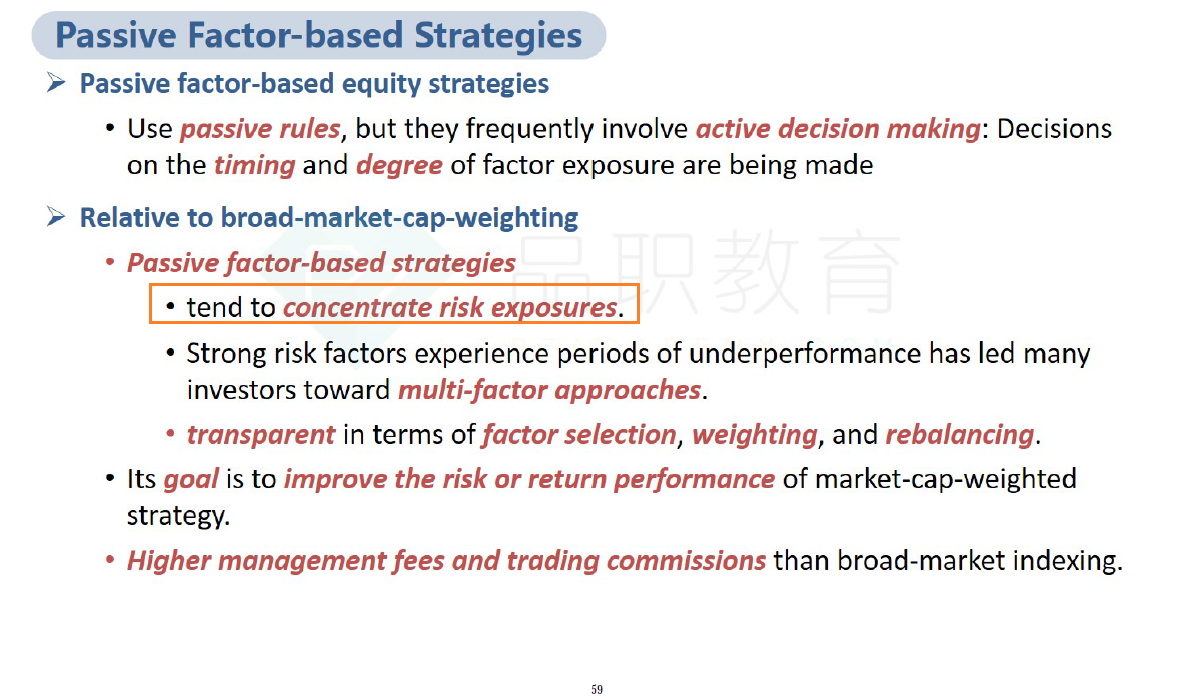

Relative to broad-market-cap-weighting, passive factor-based strategies tend to:

选项:

A.be based on the efficient market hypothesis.

B.concentrate risk exposure.

C.overweight stocks that recently experienced large price decreases.

解释:

B is correct.

考点:Passive Factor-based Strategies

解析:基于被动因子的策略倾向于集中风险敞口,使投资者在选定的风险因子表现不好的时期面临较大的风险。

请问为什么基于factor的会增加风险集中呢?factor不是可以很好的做风险平价么?