NO.PZ201602060100001005

问题如下:

Based on Byron’s forecast, NinMount’s 2019 return on beginning equity most likely will be the same under:

选项:

A.either of the consolidations, but different under the equity method.

B.the equity method, consolidation with full goodwill, and consolidation with partial goodwill.

C.none of the equity method, consolidation with full goodwill, or consolidation with partial goodwill.

解释:

A is correct.

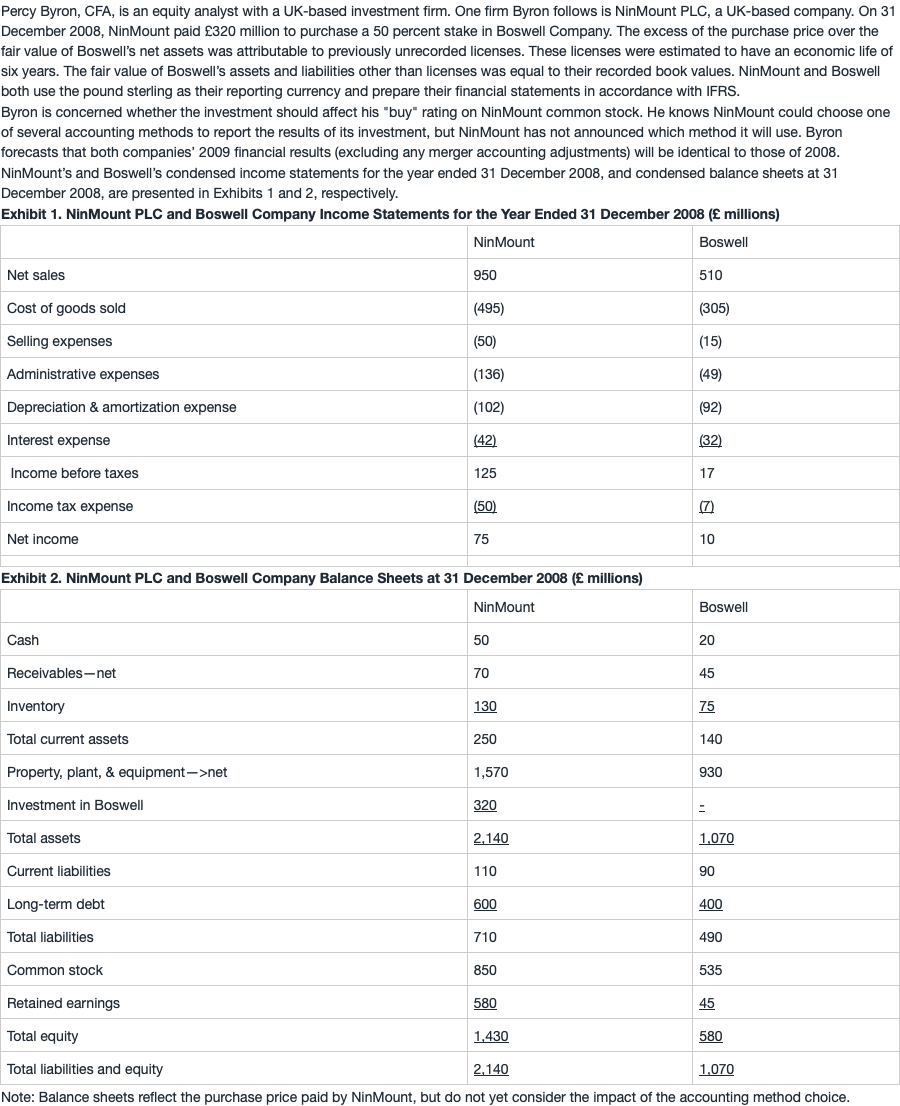

Net income is the same using any of the choices. Beginning equity under the equity method is £1,430. Under either of the consolidations, beginning equity is £1,750 since it includes the £320 noncontrolling interest. Return on beginning equity is highest under the equity method.

考点 : 不同的合并会计报表方法对会计比率的影响

解析 :

ROE=NI/Equity

对于分子来说,无论哪种方法下NI都是一样的(上课讲过的结论)。

分母equity:在equity method下,不存在少数股东权益,equity是归属于母公司本身的equity。

而在consolidation method下,因为是百分百合并,所以equity中应该在母公司本身的equity基础上再加上少数股东权益。(只要不是100%控股,就会有MI)

因此equity method下的equity更小,ROE更大。

因为这一题没有goodwill(具体解释可以看第一小问解析),所以无论是partial goodwill还是full goodwill的consolidation,计算的MI没有区别,因此两种计量方法下的equity一样。

综上,不管是哪种goodwill方法的consolidation,ROE都一样,但equity method计算的ROE不一样,选项A正确。

【知识点提示】假设题目中存在goodwill,那么full goodwill金额更大,所以对应的MI的金额也更高,在这种情况下,consolidation with full goodwill的equity比paritial goodwill更高。

我选了C, 请麻烦翻译一下C是什么意思?谢谢