NO.PZ201902210100000106

问题如下:

If Winslow is allowed to hedge into any of the currencies, she can obtain the highest expected returns by

选项:

A.buying the Greek 5-year in each portfolio and hedging it into Pesos.

B.buying the Greek 5-year in each portfolio and hedging it into USD.

C.buying the Mexican 5-year in each portfolio and not hedging the currency.

解释:

A is correct.

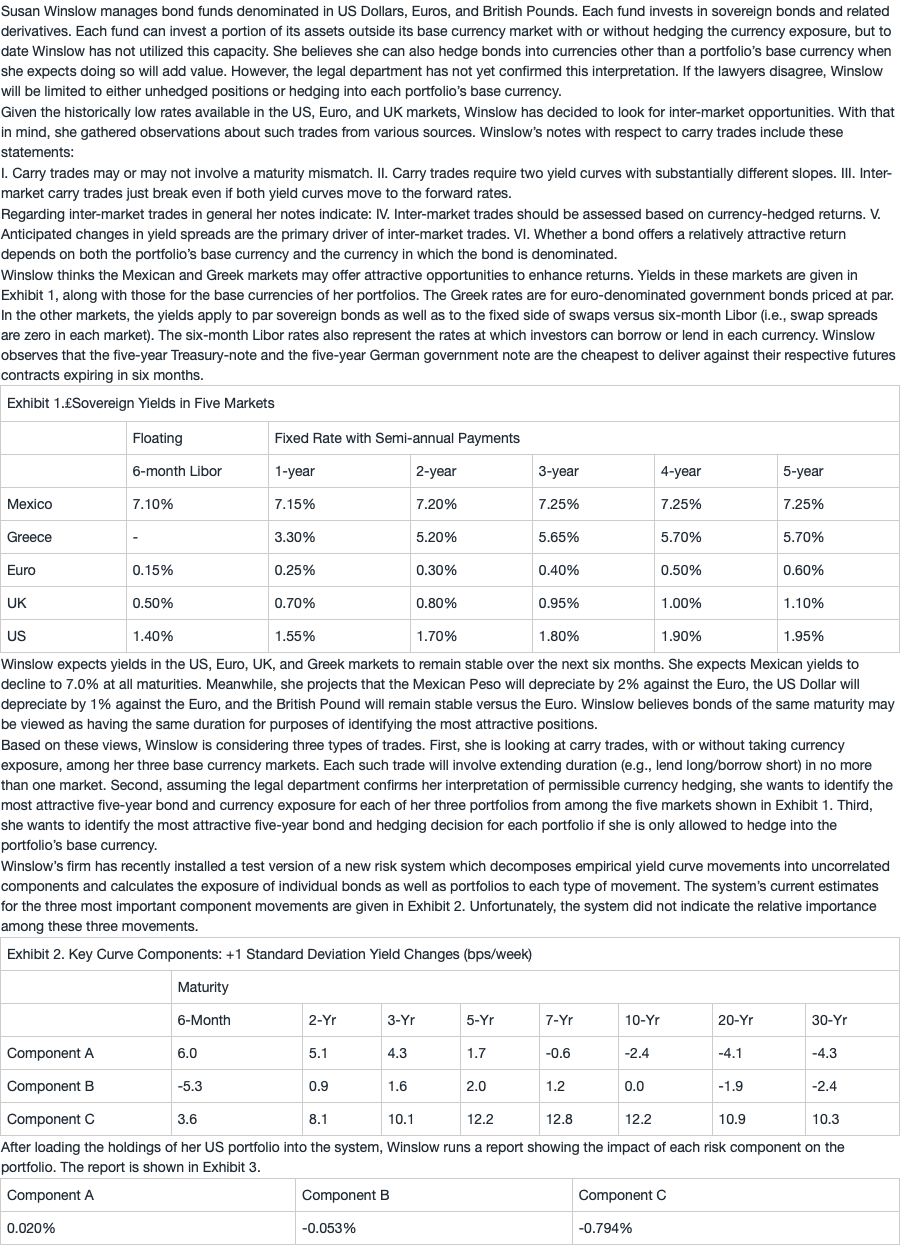

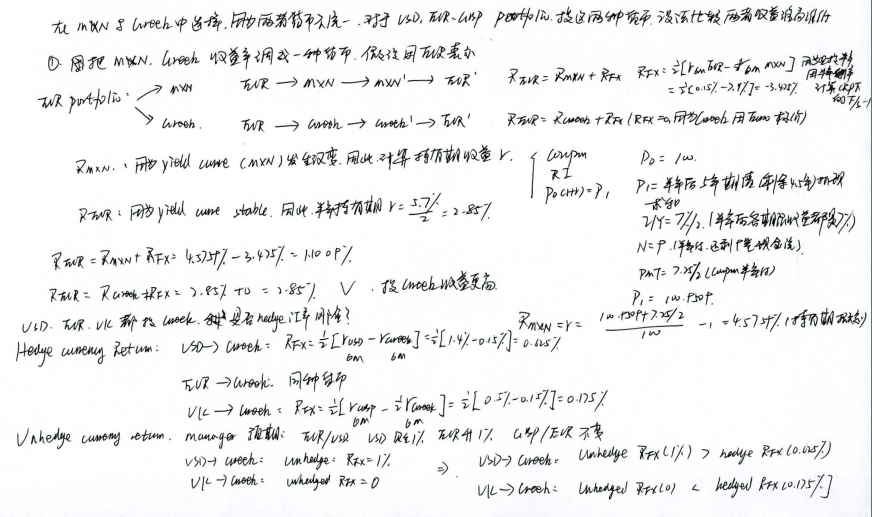

As shown in the previous question, the Greek bond is the most attractive. Although the Peso is expected to depreciate by 2% against the EUR and the GBP and by 1% against the USD, this is less than the benefit of hedging EUR into MXN (+3.475%). The net currency component of the expected return is +1.475% = (3.475% – 2.0%) for the EUR and GBP portfolios and +2.475% = (3.475% – 1.0%) for the USD-denominated portfolio. Hedging into GBP would add only 0.175% for any of the portfolios. Hedging into USD would reduce expected return for any of the portfolios because the pick up on the hedge (+0.625%) is less than the expected depreciation (–1.0%) of the USD against the Euro and GBP.

B is incorrect. Hedging the Euro-denominated Greek bond into USD would reduce expected return for any of the portfolios because the pick on the hedge (+0.625%) is less than the expected depreciation of the USD against the Euro and GBP.

C is incorrect. As shown above, the Greek bond is more attractive than the Mexican bond.

PESO相比美元贬值的多,不是应该hedge成贬值少的货币么?