官网有一道题的答案解释和我们讲义的说明有些不一样,请帮忙解释一下,谢谢~

官网题:

问这个statement对不对:

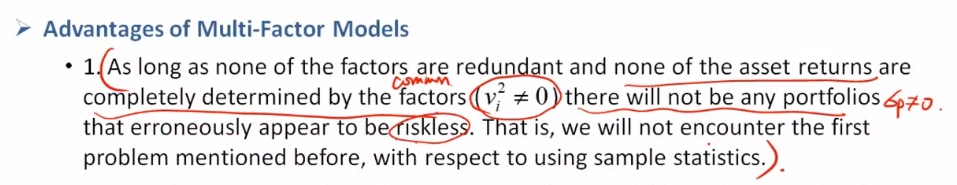

Statement 3 A factor-based VCV matrix approach may result in some portfolios that erroneously appear to be riskless if any asset returns can be completely determined by the common factors or some of the factors are redundant.

答案是:

Statement 3 is correct. As long as none of the factors used in a factor-based VCV model are redundant and none of the asset returns are completely determined by the common factors, there will not be any portfolios that erroneously appear to be riskless. Therefore, a factor-based VCV matrix approach may result in some portfolios that erroneously appear to be riskless if any asset returns can be completely determined by the common factors or some of the factors are redundant.

但我们讲义是讲:

按老师上课讲的,这个“erroneously appear to be riskless” 的特点应该是Sample statistics 才对呀?上面答案这种解释怎样理解呢?

还是说“erroneously appear to be riskless” 的这种特点即会在Sample statistics出现也会在Multi-fator model 出现?