No.PZ2021051202000012

来源:

Hudson Kelly, CFA, is an options strategy analyst at Quant Analytics, Inc., focusing on managing the portfolios of high-net-worth clients. Kelly is reviewing the IPSs for several clients to devise strategies to meet their short- and long-term objectives.

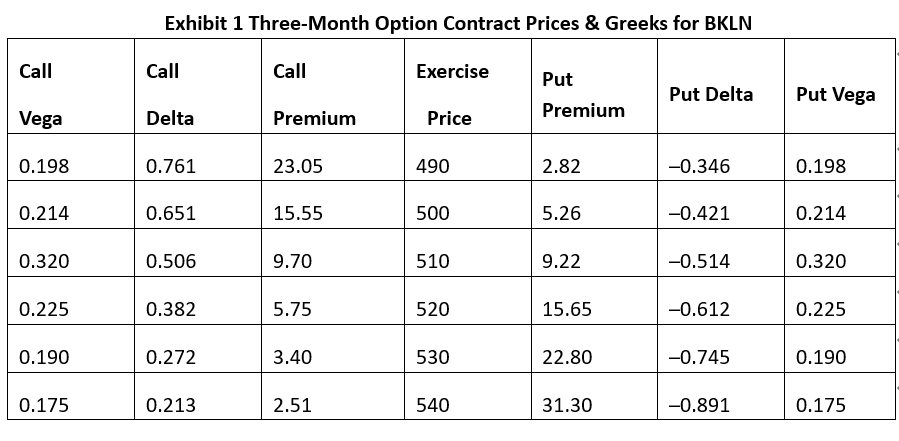

Kelly meets with Noah Jacobs, a client whose portfolio is concentrated in a single stock, Brookline Corporation (BKLN). Jacobs is confident about the long-term performance of the stock and does not want to sell any shares. Using the BKLN shares, Jacobs wants to generate an immediate cash flow of $100,000 to pay for his son’s college tuition. Kelly is tasked to come up with an option strategy that does not use naked option positions. Three-month option contract prices and Greeks for BKLN are shown in Exhibit 1.

BKLN current stock price = $510.40

Liz McPherson, a high-net-worth client, is following BKLN and is tracking its earnings history for the last few quarters. McPherson is expecting the revenue of BKLN to peak due to advancements in technology. Although the overall stock market is performing well and rising, there could be a potential downside for BKLN’s industry. Kelly recommends that McPherson establish an at-the-money (ATM) straddle strategy to benefit from possible extreme movements in the BKLN stock price.

Kelly meets with Anusha Bandla, another high-net-worth client, who expects very little price movement in BKLN. Bandla evaluates the options strategies to take advantage of BKLN’s volatility and makes the following three statements:

Statement 1: For a 1% move in the options volatility, the value of an ATM straddle would change by $0.506.

Statement 2: A short volatility strategy can be established by implementing an ATM straddle.

Statement 3: To protect downside risk, a collar strategy can be implemented by adding a long put to a covered call position.

No.PZ202105120200001201

来源:

19 . The number of BKLN covered call contracts with an exercise price of $540 required to generate the needed cash flow is closest to:

Correct Answer: C

Jacobs holds the BKLN shares. A covered call involves selling out-of-the-money (OTM) calls to receive a premium against the existing BKLN shares.

From Exhibit 1, Jacobs will sell the calls with an exercise price of $540, generating a premium of $251 per contract.

To generate $100,000 cash flow by selling $540 calls, the number of contracts to sell = $100,000 / $251 = 398.40 = 399 contracts

Could you help me understand this one? Thanks!