NO.PZ201812020100000104

问题如下:

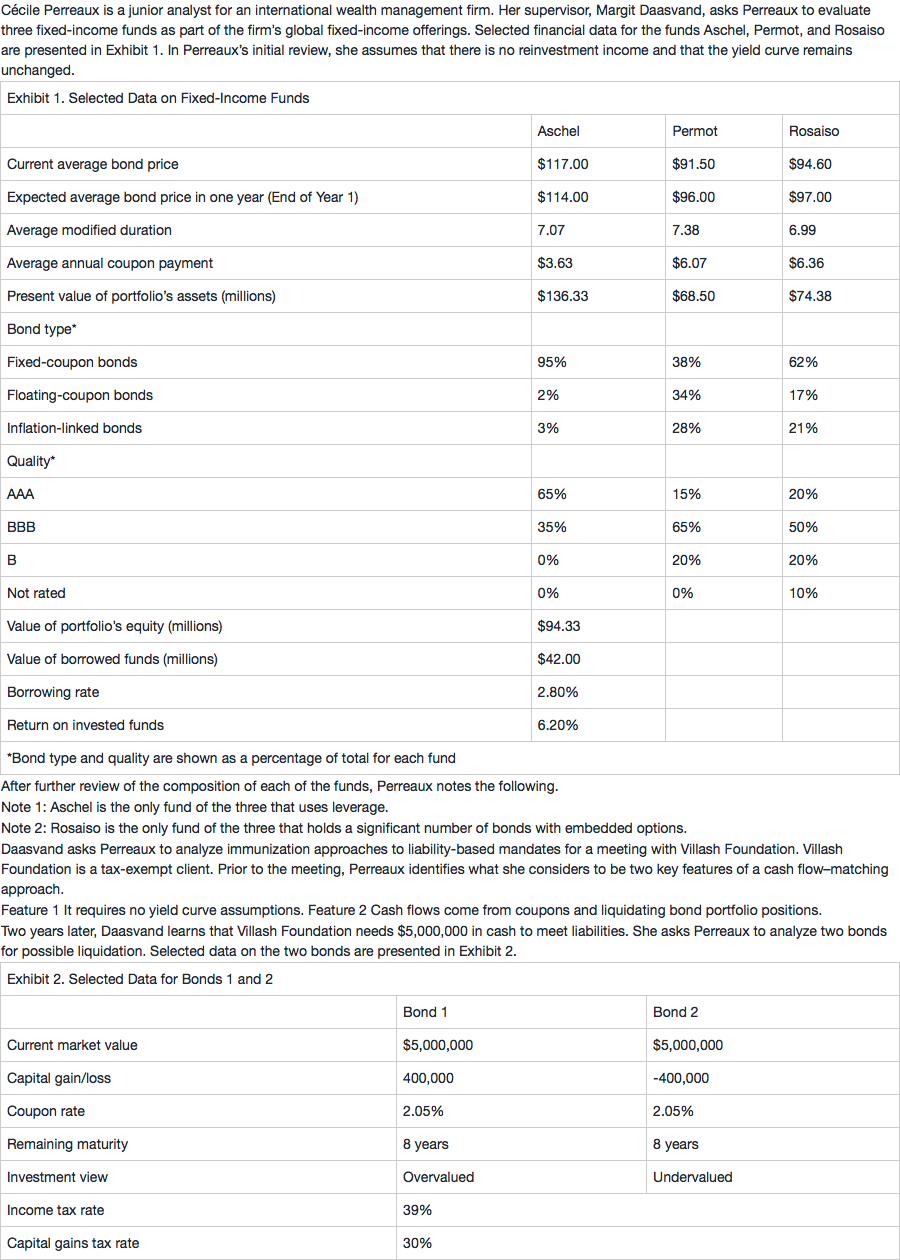

Based on Note 2, Rosaiso is the only fund for which the expected change in price based on the investor’s views of yields and yield spreads should be calculated using:

选项:

A.convexity.

B.modified duration.

C.effective duration

解释:

C is correct.

Rosaiso is the only fund that holds bonds with embedded options. Effective duration should be used for bonds with embedded options. For bonds with embedded options, the duration and convexity measures used to calculate the expected change in price based on the investors’s views of yields and yield spreads are effective duration and effective convexity. For bonds without embedded options, convexity and modified duration are used in this calculation.

老师,你好!能否问下之前的知识,convexity和effecitve convexity从性质上和公式上的区别?我有点儿记不太清了