NO.PZ2018091705000045

问题如下:

Peter is 79 years old and his wife Lucy is 68 years old. They would like to maintain their living standards with spending requirement of $300,000 in real terms.

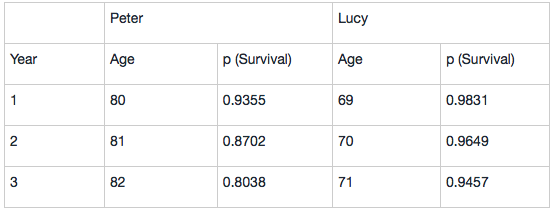

Assuming inflation rate is 2% and nominal risk-free rate is 4%. The survival probabilities for the next three years are listed in the following table:

Peter and Lucy’s core capital spending needs over the next three years are:

选项:

A. 860,490

B. 900,000

C. 824,659

解释:

A is correct.

考点:Estimating core capital with mortality tables

解析:每年存活的联合概率为:

第一年: P (joint survival) =0.9355+0.9831-0.9355×0.9831=0.9989

第二年:P (joint survival) =0.8702+0.9649-0.8702×0.9649=0.9954

第三年:P (joint survival) =0.8038+0.9457-0.8038×0.9457=0.9893

每年的必要支出为300,000,该数字是in real terms,而不是nominal,因此需要用real rate进行折现,real rate=nominal free risk rate- inflation rate=4%-2%=2%

第一年现值=(300,000×0.9989)/(1+2%)=293,794

第二年现值=(300,000×0.9954)/(1+2%)^2 =287,024

第三年现值=(300,000×0.9893)/(1+2%)^3 =279,672

因此core capital=293,794+287,024+279,672=860,490

老师您好,请问要如何用本题real spending和real risk free rate的方法计算基础班讲义上的例题呢?讲义上的inflation rate是2%,risk free rate是2%,计算时spending有乘以 1+inflation rate,但求PV时用的是 1+2%的折现率,基于分子和分母一致,可以得知例题给的risk free rate 2%是real而非nominal?如果用real的方法计算,real risk free rate = nominal risk free rate - inflation rate = 2% - 2% = 0,所以若用real的方式计算,分母的折现率应该用1+0%吗?这样算出来的结果和例题给的答案似乎不同,麻烦老师解惑,谢谢!