NO.PZ201710100100000405

问题如下:

5. If Frazee added the assumption he is considering in Fund W’s portfolio construction, it would most likely result in:

选项:

A.a decrease in the optimal aggressiveness of the active strategy.

B.the information ratio becoming invariant to the level of active risk.

C.an increase in the transfer of active return forecasts into active weights.

解释:

A is correct.

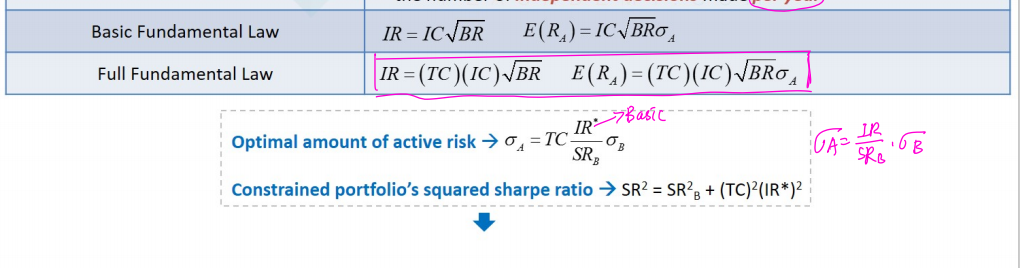

The new assumption adds constraints to Fund W. The IR for a constrained portfolio generally decreases with the aggressiveness of the strategy because portfolio constraints reduce the transfer of active return forecasts into active weights. Furthermore, the optimal active risk is given by the following formula:

The addition of portfolio constraints reduces the TC, thus also reducing the optimal active risk. So, having maximum over- and underweight constraints on single-country positions decreases the optimal aggressiveness of the active management strategy

考点:The full fundamental law

解析:由于constraints的引入,

A, optimal amount of active risk 的公式变为:,也就是增加了TC项,增加限制条件导致TC<1,因此optimal amount of active risk减小,A正确。

B,错误。没有constraints时,IR不受aggressiveness的影响;但是增加限制条件使得基金经理实现自己想法的难度增加,因此IR会减小。

C,错误,增加限制条件使得基金经理实现自己想法的难度增加,因此将预期的active return转为实际投资组合构建的程度下降,因此TC会减小。