NO.PZ2016072602000016

问题如下:

Which of the following statements about its methodology for calculating an operational risk capital charge in Basel II is correct?

选项:

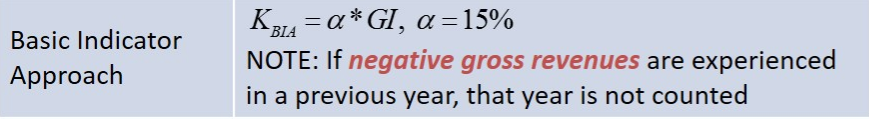

A. The basic indicator approach is

suitable for institutions with sophisticated operational risk profiles.

B. Under the standardized approach, the

capital requirement is measured for each of the business lines.

C. Advanced measurement approaches will

not allow an institution to adopt its own method of assessment of operational

risk.

D. The AMA is less risk sensitive than

the standardized approach.

解释:

B is correct. The BIA is suitable for banks with basic risk profiles, so answer a. is incorrect. The AMA is an internal model, so answer c. is incorrect. The AMA is more risk sensitive than the standardized approach, so answer d. is incorrect.

不懂a选项,谢谢,呃呃呃