NO.PZ2018101501000129

问题如下:

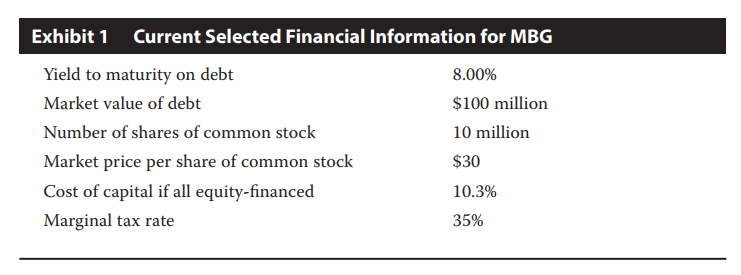

To evaluate the potential impact of such a capital structure change on Greengable’s investment, she gathers the information about MBG given in Exhibit 1 :

MBG is best described as currently:

选项:

A.25% debt-financed and 75% equity-financed

33% debt-financed and 66% equity-financed

75% debt-financed and 25% equity-financed

解释:

A is correct. The market value of equity is ($30)(10,000,000) = $300,000,000. With the market value of debt equal to $100,000,000, the market value of the company is $100,000,000 + $300,000,000 = $400,000,000. Therefore, the company is $100,000,000/$400,000,000 = 0.25 or 25% debt-financed

比如计算发债融资的税后成本