NO.PZ2016070202000023

问题如下:

Assume that implied volatilities from equity option prices display a volatility skew and that implied vols from currency option prices display a volatility smile. Which of the following statements about option price implied volatility curves are true?

I. The implied volatility of a deep out-of-the-money equity put option is higher than that of a deep-in-the-money equity put.

II. The implied volatility of a deep out-of-the-money equity call option is higher than that of an at-the-money equity call option.

III. The implied volatility of a deep in-the-money currency call option cannot be the same as that of a deep in-the-money currency put option.

IV. The implied volatility of a deep out-of-the-money currency call option is higher than that of an at-the-money currency call option.

选项:

A.I and III only

B.I and IV only

C.II and III only

D.II and IV only

解释:

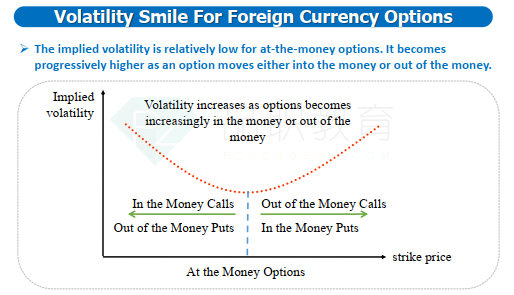

A volatility skew means that, for equities, the ISD of out-of-the-money (OTM) puts is greater than that of ITM puts, so answer I. is true. Conversely, the ISD of ITM puts, or equivalently that of OTM calls, is similar to that of ATM options, so answer II. is false. A volatility skew means that, for currencies, the ISD of out- of-the-money options is greater than that of ATM options, so answer IV. is true. On the other hand, OTM and ITM options might have similar vols (for currency options), so answer III. is false.

d选项不应该是错的吗?isd又是什么意思