NO.PZ2020033002000090

问题如下:

Persimmon Bank ’s current total assets are US $ 20 million, while short-term liabilities are US $ 6 million and long-term liabilities are US $ 3 million. Its annual volatility of assets is 15%. According to the KMV model, what is its default point and distance to defualt?

选项:

A.$7.5 million and 3.67

B.$9 million and 3.67

C.$7.5 million and 4.17

D.$9 million and 4.17

解释:

C is correct.

考点:The KMV Approach and Estimation Approaches

解析:default point就是短期负债加上长期负债的一半,也就是6+1.5= $7.5 million.

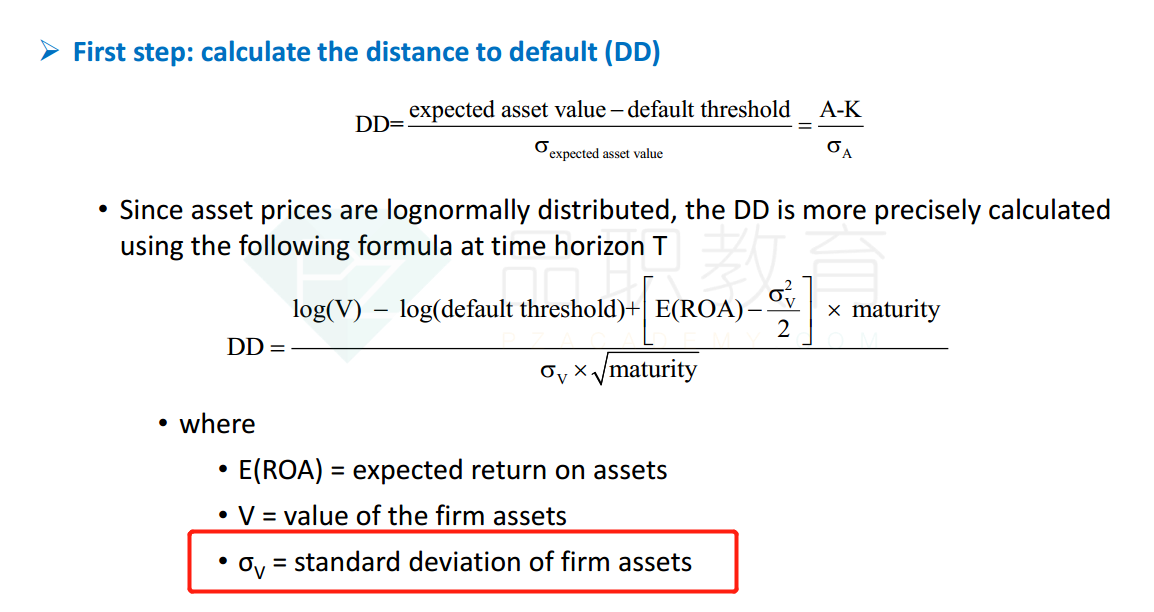

Distance to default是 \frac{20-7.5}{20\times15\%}=4.17

基础课件184页, DD的简单公式不是应该(A-K) / sigma(expected asset value) 吗,可以讲下为什么答案那么算分母嘛。 还有就是我发现2020年的题库,答案公式都看不是很清楚,都是代码形式的那种,希望可以调整下,谢谢